The current status of BEPS Pillar Two adoption by country

While 142 countries have agreed to the framework, BEPS Pillar Two will come into effect on a country-by-country basis. Countries aren’t all on the same page yet, but they will be soon. At the time of writing, 27 countries are in the process of enacting regulations. The EU, South Korea, and Japan recently published directives for adoption. The Americas and the rest of Asia Pacific are expected to follow shortly.

Here is the status of BEPS Pillar Two for countries that have green-lit enforcement:

On track to enforce in 2024

|

Intent to enforce by 2024

|

Intent to enforce by 2025

|

Germany

Netherlands

Sweden

Switzerland

UK

Japan

South Korea |

Belgium

France

Italy

Spain

Lichtenstein

UAE

Australia

Indonesia

New Zealand |

Hong Kong

Singapore

Thailand |

Source: KPMG

For MNEs in countries that have yet to announce BEPS Pillar Two enforcement, like the US, we suggest carefully watching how companies from early adopting regions handle BEPS Pillar Two, the challenges they face, what enforcement looks like, and how countries react. It will be helpful in developing your tax reporting program when your time comes.

What challenges does BEPS Pillar Two pose to multinational enterprises?

Applying a 15% tax may sound straightforward, but it presents several operational complexities that corporations should be aware of as they kick off their new tax reporting journey. Specifically, we see the following changes as the biggest hurdles to meeting BEPS Pillar Two requirements:

1. Material impacts: In instances where top-up taxes apply, companies will have to pay out more to regulators or revisit their global structures, value chains, and the location of their activities in order to mitigate material impacts. The potential tax impact could be significant, increasing cash tax costs and reducing earnings per share.

2. New financial statement disclosures: MNEs will have to indicate the jurisdictions that have potential exposure to top-up tax in their financial statements. This means they’ll have to prepare by running calculations to determine whether top-up taxes are needed, what the amount will be, and add this to their existing financial close process.

3. Data management: BEPS Pillar Two calculations require companies to pull data in from over 250 new sources, per entity, across multiple countries. Collecting and normalizing this data will be challenging for corporations that use different systems regionally.

4. Process change: Filing impacts companies at the group level, which means that financial close and consolidation processes must adjust to accommodate new data requirements. What’s more, BEPS Pillar Two will require a degree of change management. Employees will have to receive education and training on new processes, systems, and the regulation itself.

5. Tech changes: ERP systems aren’t robust enough to support the complexity of BEPS Pillar Two. MNEs should carefully consider their global tech stack. We recommend implementing a CPM solution, like CCH Tagetik Global Minimum Tax, that can manage all impacted processes across the enterprise, namely the close, consolidation, and provisioning for BEPS Pillar Two.

6. Connecting finance and tax: Tax and finance departments have historically been siloed, but BEPS Pillar Two requires these two departments to work closely together with open lines of communication, shared data, and integrated systems.

7. Limited time to prepare: Companies have less than a year to report tax positions in statements — which also means they have less than a year to financially prepare, adjust their processes, and refine data processes.

8. Regulatory changes: Different nations will take different approaches to BEPS Pillar Two, and many companies are afraid to start the adoption process in case more changes come down the line. An agile approach to tax reporting is required.

9 Strategy: Going forward, companies will have to make decisions based on minimum tax provisions, such as determining where to build factories or side operations to minimize or manage material impacts. Tax will be strategically incorporated into decision making from here on out.

A deep dive on BEPS Pillar Two data requirements

A recent FSN & Wolters Kluwer webinar explored the impacts of global minimum tax and broke down three ways data management under BEPS Pillar Two will impact existing processes.

New data requirements

BEPS Pillar Two filings will draw on 250 new non-financial data points per entity. So, if your organization has 200 entities, that’s over 50,000 new data sets that you need to pull into your systems. Going forward, tax will have a presence in your financial close, quarterly statements, and on your annual report.

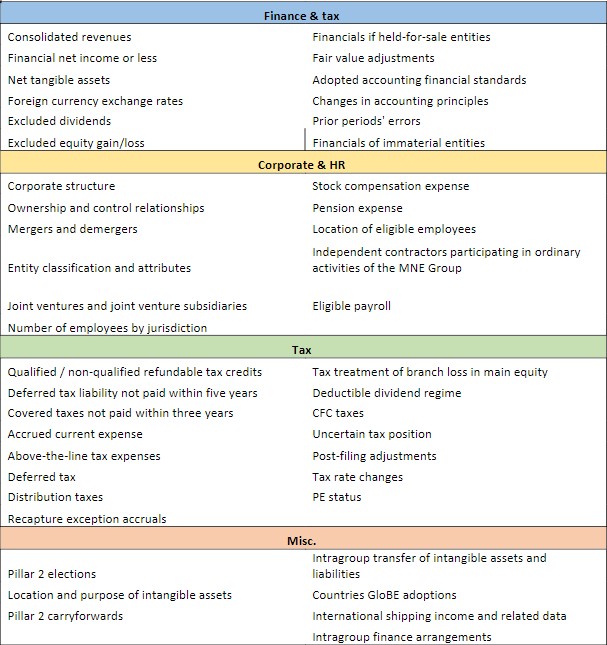

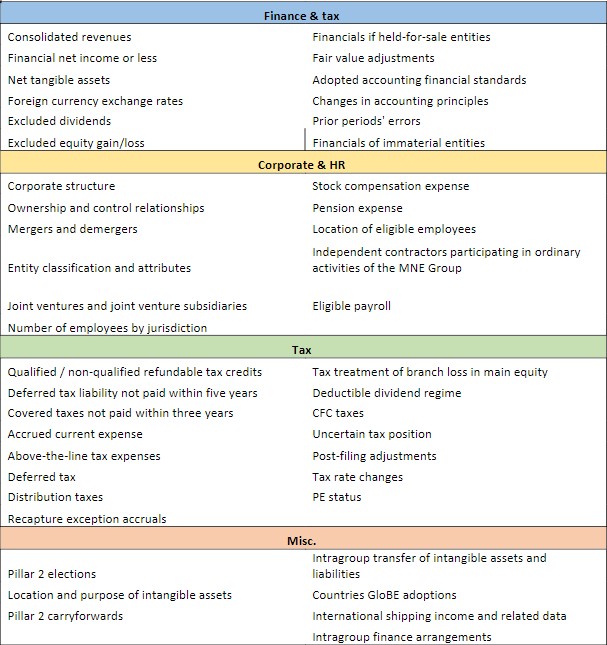

Here are just some of the data points MNEs will be responsible for managing:

Effective tax rate (ETR) + constituent entities

Unique to BEPS Pillar Two is the need to understand constituent entities, which differ from legal filing entities, and the need to calculate your effective tax rate. Corporations must add the effective tax rate formula, which requires the 250 data points mentioned above when creating financial statements.

Global calculations and impacts on consolidation

Pillar Two’s global calculations are complex because local or in-country organizations must collect information and send it up so that you can perform consolidation at the top. As a result, global consolidation processes will have to change to accommodate tax where it didn’t have to before.

Where should you begin?

Collecting and normalizing the data required to calculate BEPS Pillar Two liabilities will require a data management overhaul. And transforming your tax and consolidation processes will take time.

The first step to PEPS Pillar Two preparedness should be to run an impact assessment.

Consider the following questions:

- What entities in your business are subject to BEPS Pillar Two?

- Are any jurisdictions eligible for safe harbor status?

- What will the approximate cash impacts on your corporation be?

- What are your “at-risk” jurisdictions for top-up tax?

- How will you pull data in from multiple new sources?

- Can your current systems accommodate new calculations on large data sets? How long will it take to produce results?

- What does the BEPS Pillar Two workflow look like?

- What governance measures will you need to implement to ensure data accuracy?

- Can you easily adjust your tax and consolidation processes to accommodate future BEPS Pillar Two updates and rule changes?

- Can your current technology support BEPS Pillar Two’s complex requirements and quick adoption or should you consider implementing a new solution?

Ease into the BEPS Pillar Two Transition —fast — with CCH Tagetik Global Minimum Tax

By directly connecting BEPS Pillar Two data with consolidation, our solution harmonizes the new tax process across local closing and group consolidation. With these processes fully aligned, you’ll meet BEPS Pillar Two reporting needs while being able to assess its material impacts.

Learn more about CCH Tagetik Global Minimum Tax >