In our first commentary we explained the background to the new prudential regime for MiFID investment firms and discussed how to figure out if your firm is in Class 2 or 3. In the second commentary we took a closer look at the new K-factors that are applicable to Class 2 firms. In this final commentary we will explore how firms will need to report the data they have collected and what they should be doing to prepare for the introduction of the new regime laid out in the Investment Firm Regulation (IFR)

The European Banking Authority (EBA) has incorporated K-factors into a new set of obligations covering regulatory reports for Class 2 firms. The Financial Conduct Authority (FCA) began consulting on implementation of a new reporting requirement for UK firms in December 2020 through Consultation Paper CP20/24, and what we can tell already is that the FCA requirements will be a lot simpler than the EBA’s, at least on the surface.

As set out by the EBA, EU Class 2 firms will need to report quarterly regulatory returns for the first time for the period ending 30 September 2021 and file their first submission by 11 November. Class 3 firms will have to report annually beginning with the period ending 31 December 2021 and submit by 11 February 2022. Class 2 and 3 firms that must submit disclosure reports will have to do so when they publish their annual accounts, starting with the one due after 26 June 2021.

UK firms, especially larger or interconnected Class 2 firms (non-SNIs), have been given a break with the recent announcement that the introduction of the new regime has been delayed at least until January 2022. Based on this date, and the single suite of reporting returns for all investment firms that the FCA will require under CP20/24, smaller and non-interconnected (SNI) Class 2 and Class 3 firms will begin reporting on 31 March 2022 and will have to submit by 28 April.

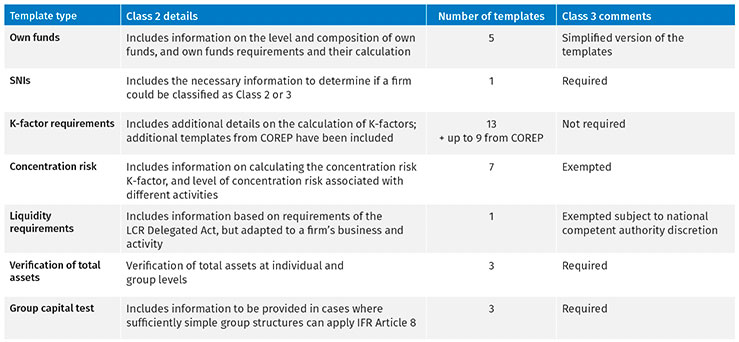

On paper the EBA’s implementation of the reporting requirements set out in IFR Article 54 is more onerous for Class 2 firms, compared to the current reporting regime under the Capital Requirements Regulation (CRR 2). It is also more onerous than what the FCA has in mind in the UK. This could make the UK more attractive to investment firms. The EBA will require many quarterly reports for Class 2 firms, as detailed in the table below, and its guidance for Class 3 firms delivers a more proportional annual reporting requirement:

Figure 1

A key objective of the new framework is to introduce reporting obligations that are simplified and more in proportion to a firm’s size and complexity. The EBA’s proposals suggest that this objective will be achieved more for SNIs than for non-SNIs.

According to the proposals, there will be as many as 27 templates to complete for non-SNIs that have to report on all K-factors. Still, enough proportionality is being built in to ensure that the largest reporting obligations will be confined to firms with MiFID permission to deal on their own account and a requirement to calculate Risk-to-Market and Risk-to-Firm K-factors.

At the end of our second commentary, we discussed the concentration risk K-factor – K-CON – and the fact that firms must measure it daily, even though they must report it only quarterly. It also should be noted that concentration risk reporting requirements will go beyond K-CON. A Class 2 firm also will have to report quarterly on concentrations of:

- Client money held

- Assets safeguarded and administered

- Total own cash deposited

- Total earnings

- Trading book exposures

- Non-trading book and off-balance-sheet items.

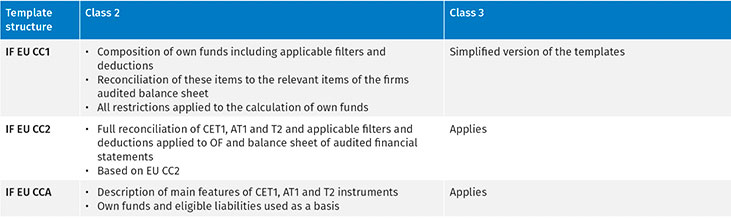

In addition to regulatory reporting requirements, the EBA will require all Class 2 firms, as well as Class 3 firms that issue Additional Tier 1 (capital) instruments, to disclose certain information annually on own funds and own funds requirements, as described below:

Figure 2

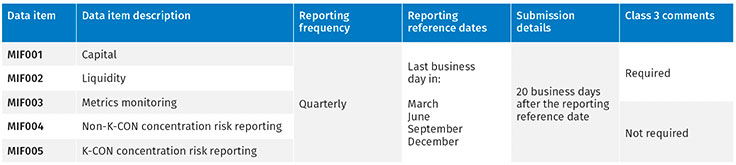

The UK reporting requirements, as defined so far by the FCA, are far simpler than those for the EU, as shown in the table below. In its second consultation paper on implementing the new prudential regime, which is expected to be published at the start of the second quarter of 2021, the FCA will seek further input on fixed overhead requirements and liquidity. The former certainly will lead to further reporting obligations. Although the FCA is not proposing to routinely collect detailed information on K-factor calculations, firms will be expected to provide this information upon request. This means their systems and processes will have to be particularly transparent, auditable, immediately accessible and robust

Figure 3

The FCA will consult on the UK investment firm disclosure requirements in their third consultation paper, expected at the start of the third quarter of 2021.

What should firms be doing now?

We have focused in these commentaries on the new K-factors and reporting obligations introduced or proposed under the new prudential regime for investment firms. It is important to note that these are not the only changes being introduced. Firms need to familiarize themselves with the whole regime and its impact on other important areas. These include, but are not limited to:

- how to determine fixed overhead requirements

- the Internal Capital Adequacy and Risk Assessment process for Pillar 2

- Disclosures around investment policy and environmental, social and governance risks

- Transitional provisions.

A firm’s first priority, however, should be to determine if it is in Class 2 or 3. Class 2 firms must assess which K-factors are applicable to them and whether their people, processes and systems are able to meet monitoring and reporting obligations. A firm that finds deficiencies must start to build a business case to fund projects that will re-engineer its processes and systems to meet compliance deadlines.

Class 2 firms will be expected to file submissions as early as 11 November 2021 for their third-quarter data. That gives them less than one year to implement changes. That is not long at all, given the extensive preparations the changes are likely to demand. Firms cannot wait until the regulatory framework is finalized to begin their projects. A primary reason for the EBA and FCA publishing consultation and discussion papers is to alert the industry that preparations must start now. This is an urgent matter that must be at the forefront of the thinking of every CEO, CFO and CRO.

Wolters Kluwer can help firms meet their K-factor and reporting obligations under the new regime through our OneSumX Regulatory Reporting for Investment Firms solution, delivered on the multiple award-winning OneSumX platform. Our modular, SaaS-enabled solution not only delivers compliance today, but ensures continued compliance through our unique regulatory update service. If you are interested in learning more about how Wolters Kluwer can help, please contact us here.