By: Craig Focardi, Principal Analyst, Celent

Preparing for the onslaught: Managing compliance when markets change

Banking and financial markets are beginning to feel the effects of inflation and rising interest rates in 2022. After more than a decade of mostly low inflation, declining interest rates and rising stock markets, markets are poised to head in the opposite direction. The economy and banking are at an inflection point with market conditions that portend ominous changes. It is important to recall that the regulatory pendulum shifted dramatically during the 2008 financial crisis, which exposed weaknesses in prior compliance management. Although many compliance improvements have been made since then, the key question as we approach 2023 is what compliance gaps will the current inflation crisis reveal, and what should financial institutions do today to better manage through what an uncertain future brings?

The 2008 Financial Crisis, Great Recession, and Compliance Hangover

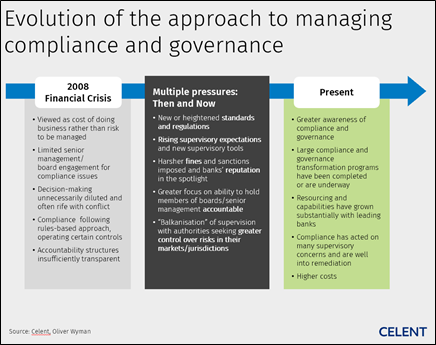

Prior to the 2008 financial crisis followed by the Great Recession, compliance was viewed more as a burdensome cost of doing business than an essential process that provides financial safety and soundness, consumer protection, and good management of systemic risk in banking. Oftentimes there was insufficient senior management/ board engagement for compliance issues, decision-making unnecessarily diluted and often rife with conflict, and compliance governance and accountability structures were insufficiently transparent.

The past decade has seen a lot of positive-and sometimes burdensome-regulatory compliance in reaction to the previous crisis. While the financial services industry is in a much better structural condition, regulatory compliance is a continuous improvement process where some financial institutions lag others, and the regulatory goalposts are sometimes moved further away.

The Regulatory Pillars

The exhibit below depicts the federal regulatory structure for financial institutions (FIs). For smaller community banks and credit unions, perhaps only two of these four houses of regulation significantly impact them on a daily basis. However, for midsized to large FIs, all four apply and are a daily focus of regulatory compliance, compliance process management, and technology.

Moreover, the individual posts within each of the four houses sometimes overlap in regulatory requirements, reporting, and data collection. Some of this makes logical sense; perhaps some of it does not. For example, although the Dodd-Frank Act consolidated a lot of consumer protection regulation into the Consumer Financial Protection Bureau (CFBP), the prudential regulators regularly create new laws, rules, and guidance that the CFPB implements and enforces. The key point is that compliance is complex, overlapping between regulators for certain issues, and is ever changing.

Call to Action

We’re at an unprecedented inflection point in the economy, financial markets, and financial services. We have learned that financial safety and soundness trumps systemic risks and institutional failures any day, but this time it’s different with inflation, rapidly rising interest rates, lower lending volume, and more pressures on the business, which will put new pressures on regulatory compliance.

I spoke on a Compliance Week webinar “When You Have to be Right: The Top 10 Compliance Management Considerations for 2023 “on 9-29-22 along with Elaine Duffus, Senior Specialized Consultant, Wolters Kluwer Compliance Solutions. Elaine brings more than 20 years of professional expertise to her role, including several as Chief Compliance Officer in the insurance, securities, and banking industries. Watch our on-webinar to learn how you and your organization can shore up your ethics and compliance programs – and as you prepare for 2023, the top compliance management considerations that should be on your radar.