Overview

Treasury Regulation Section 1.408-8, Q&A-10, requires individual retirement account (IRA) custodians and trustees to provide certain required minimum distribution (RMD) information to IRA owners and the Internal Revenue Service (IRS) each year. IRS Notice 2002-27 provides guidance relating to the information IRA custodians and trustees are required to include in this annual RMD notification. This article explains each component of the annual RMD notice requirement.

RMD notice recipients

IRA custodians and trustees are required by January 31 each year to send an RMD notice to traditional, traditional simplified employee pension (SEP), and traditional Savings Incentive Match Plan for Employees of Small Employers (SIMPLE) IRA owners who are required to take a distribution for that year. IRA custodians and trustees are not required to send an RMD notice to beneficiaries who are required to take minimum distributions after an IRA owner’s death.

RMD notice content

IRS Notice 2002-27 provides two methods for satisfying the RMD notice requirement. An IRA custodian or trustee can:

- Calculate an IRA owners RMD using the Uniform Lifetime Table with no adjustment to the IRA’s previous year-end balance and indicate the RMD due date, or

- Offer to calculate the RMD upon an IRA owner’s request and indicate the RMD due date

If using the first method listed above, an IRA custodian/trustee is permitted to calculate the RMD assuming that the sole beneficiary of the IRA is not the IRA owner’s “more than 10 years younger” spouse. This essentially allows calculation of RMDs using a divisor from the Uniform Lifetime Table in all cases. Additionally, when calculating the RMD for notification purposes, custodians and trustees do not have to adjust account balances for amounts deposited to an IRA after December 31 of the prior year.

Notification methods

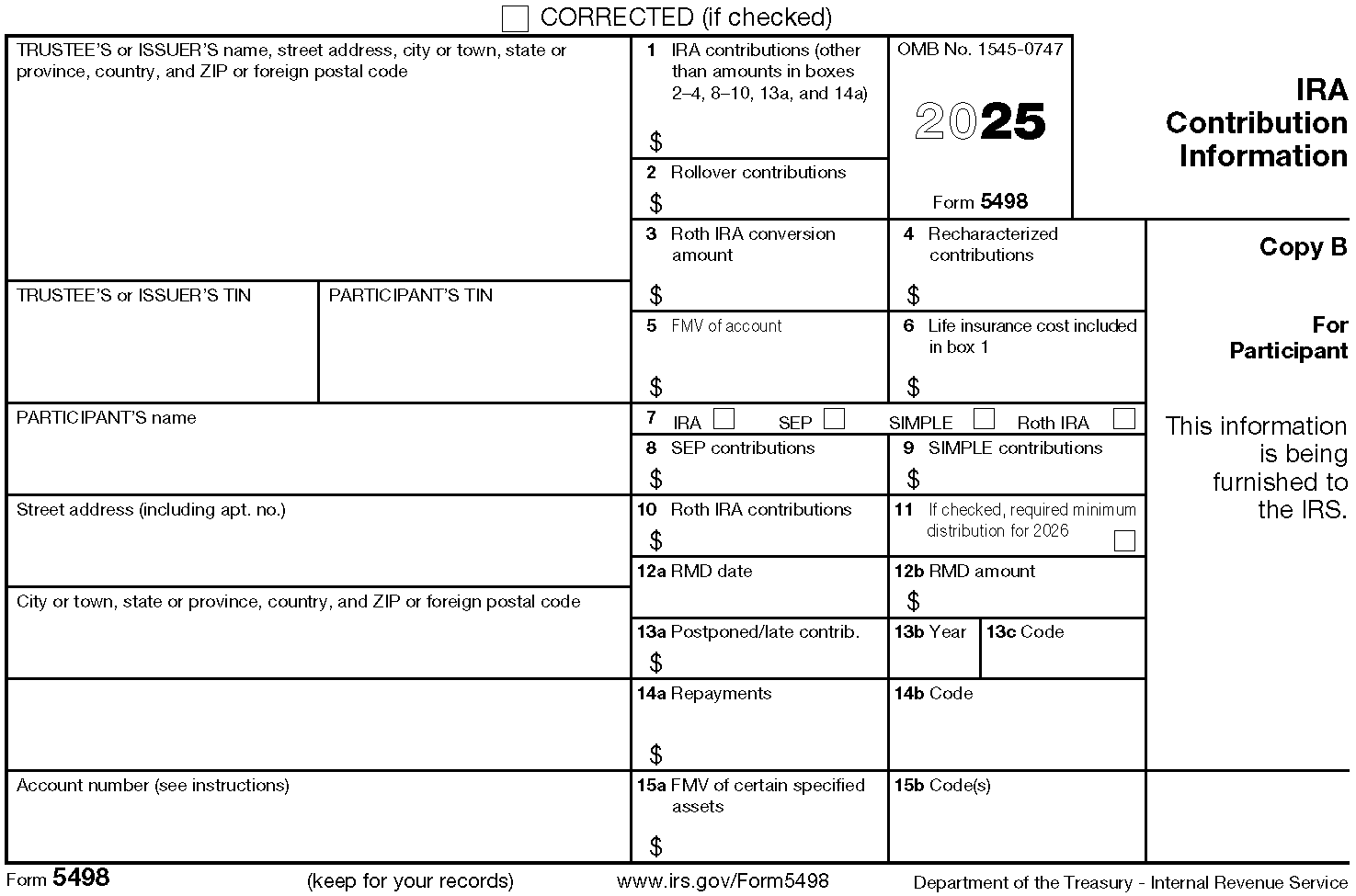

IRS Notice 2003-3 allows financial organizations to use one notice method for some IRA owners and the other method for everyone else. Under either method, the RMD notice must also inform an IRA owner that the financial organization will notify the IRS of his/her required distribution obligation. Notification to the IRS is met by checking box 11 (paper version) of IRS Form 5498, IRA Contribution Information.

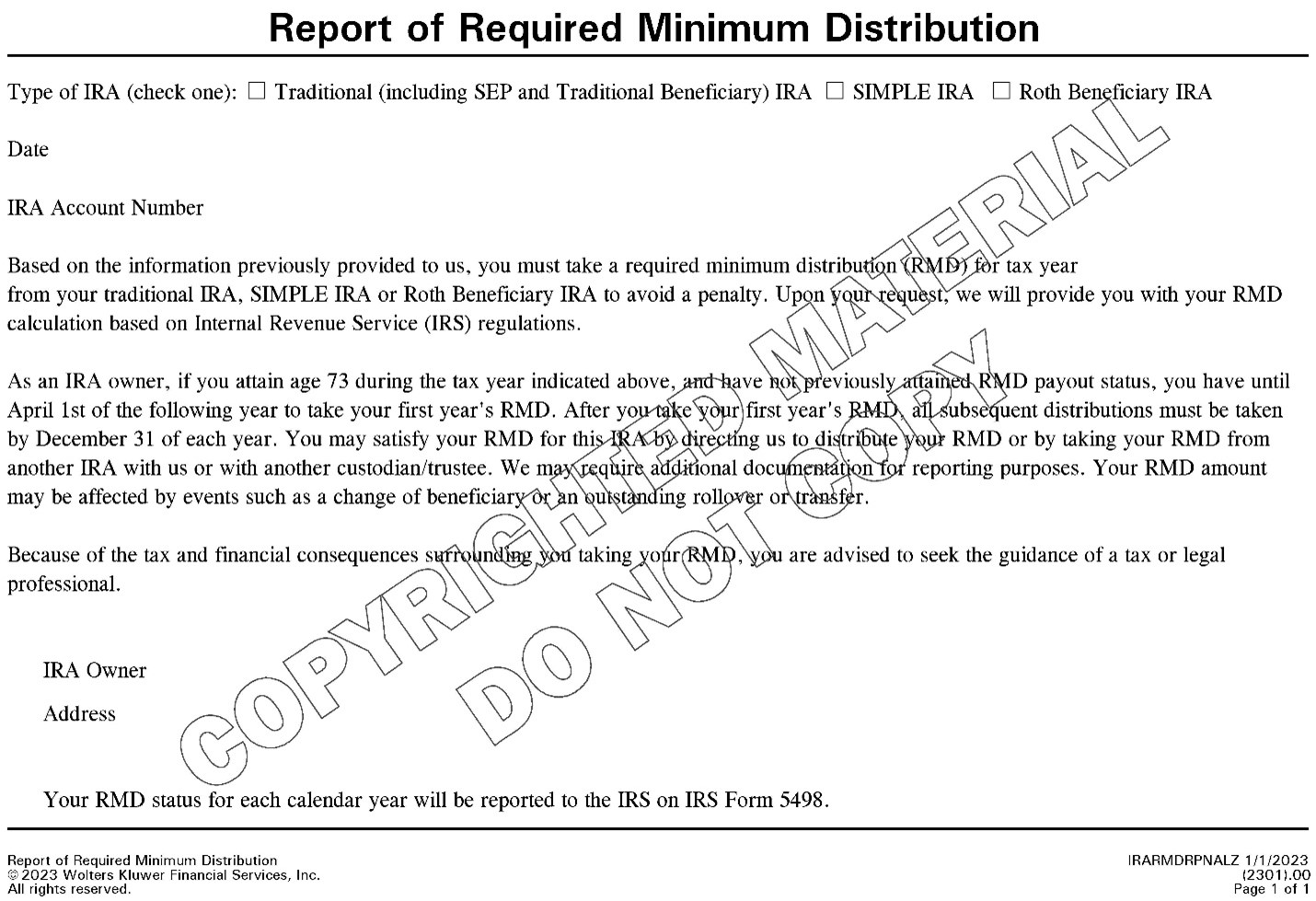

IRA custodians and trustees may satisfy the RMD notice requirement to IRA owners by sending IRS Form 5498 to them by January 31 with optional Boxes 12a RMD date and 12b RMD amount filled in. Alternatively, the notice requirement can be fulfilled by sending a separate statement containing the information defined above. Providing IRA owners with either the Wolters Kluwer Financial Services’ Report of Required Minimum Distribution Amount or Report of Required Minimum Distribution by January 31 will satisfy the notice requirement. As a side note, IRS Notice 2003-3 indicates a financial organization may provide the RMD notice electronically.

Conclusion

The RMD notice is primarily a reminder notice. An RMD calculated by an IRA custodian or trustee to fulfill its annual RMD notice requirement may not be completely accurate due to certain assumptions and unknowns including balance adjustments that could produce understated or overstated RMD amounts. Additionally, keep in mind that an IRA owner has the ultimate responsibility for calculating and taking his/her RMDs.

For an opportunity to learn more about IRAs and other tax-advantaged accounts including Health Savings Accounts and Coverdell Education Savings Accounts, consider the Wolters Kluwer IRA Library or our on-demand video training offered on a variety of topics. Go here to learn more about training opportunities available to you, or you can call us at 1-800-552-9408.