Rising to the challenge of the EBA IRRBB reforms

The challenges of meeting new regulations for IRRBB

In 2008, in response to the global financial crisis, liquidity risk regulations were introduced under Basel, with banks required to calculate and report Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR). Corresponding Interest Rate Risk measures (IRRBB) were only ever given as guidelines. Now IRRBB guidelines will be brought into the regulatory realm and banks will need to submit mandatory EBA IRRBB disclosures templates.

Up until this point there has not been a standardized model for computing EVE or NII and banks have been able to rely on their own internal models. These EBA models are not yet fully replacing the internal models in place for all banks, but they can be demanded by supervisors if internal models are not considered to be sufficient.

The EBA is expected to closely monitor the implementation of these new regulations. This will be particularly important in the current environment of rising interest rising rates, alongside high inflation, after a long period of historically low rates.

And, for the first time, CRSBB will need to be identified and dealt with as a separate risk category from IRRBB.

In a recent Wolters Kluwer poll* only 15% of respondents reported that they are currently measuring and monitoring credit risk spread separately from interest rate risk. By December 2023, this will need to be undertaken by all banks.

There are clear signs that some banks are going to struggle to meet the new regulations in the relatively short period of time available. Over 40% of respondents stated that Liquidity Risk and IRRBB are managed in different systems at their institution. Furthermore, only 20% of respondents thought their IRRBB system was likely to be satisfactory when considering the new requirements.

The importance of robust interest rate risk and liquidity risk management in the current economic climate

It would be a mistake to think of IRRBB only as a regulatory challenge. After a lengthy period of ultra-low interest rates, recent rises, together with surging inflation, have changed the environment and liquidity crises have perpetrated. Institutions need to be able to cope in these new economic circumstances. They need their ALM system to be flexible, robust and trustworthy.

In this volatile climate, stress testing continues to rise in importance for banks’ risk management strategies as well as for their supervisory bodies. In today’s market which has seen challenges around a global pandemic, climate change and geopolitical instability, banks need scenario planning tools that they can rely on. We can expect to see ongoing emphasis on stress testing capability, including scenarios relating to inflation, interest rate changes and liquidity events.

Addressing possible IRRBB shocks in practice

Taking all the guidelines into account, let’s speak through some cases which have been assumed for a typical bank’s requirements.

In these cases, a bank has a significant investment in both long-term, fixed and variable-rate loans and short-term fixed and floating-rate deposit loans and so will be sensitive to both interest rates and credit spreads.

The following examples are scenarios that a bank with such a balance sheet will need to be able to perform confidently and quickly.

-

Performing deterministic shocks on IR and CS-sensitive products

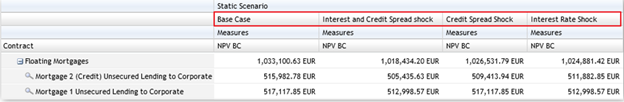

Performing deterministic shocks on IR and CS-sensitive products to undertake Interest rate risk (IRRBB), and Credit spread risk (CSRBB) analysis.

Figure 1 shows us where the shocks on the sample contracts mortgage portfolio are broken down to into interest rate and the credit spread impact.

-

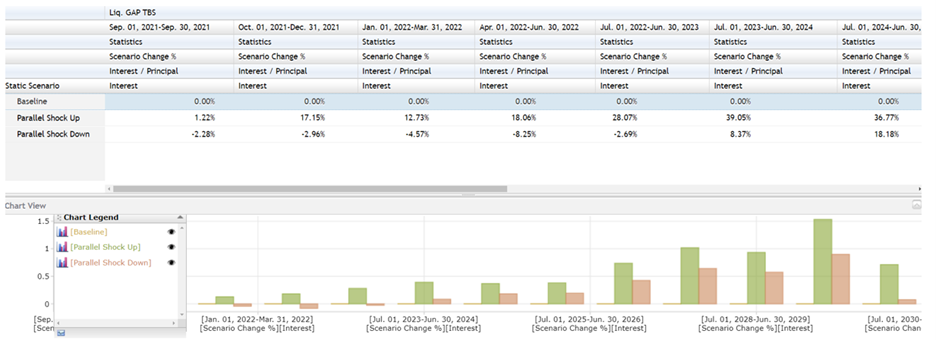

Transactional deposit and accounts sensitivity analysis under a static run-off strategy

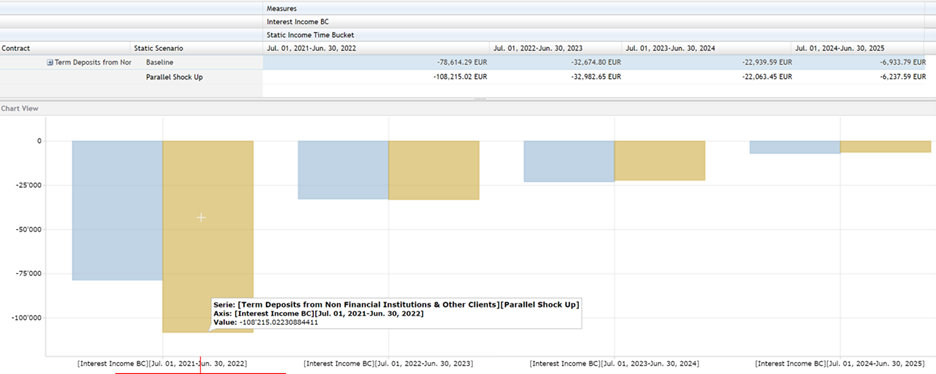

Transactional deposit and accounts sensitivity analysis where behavior risk is sensitive to the IR and CS risk factors, under a static run-off strategy.

In figure 2, we can see that under the parallel shock-up scenario, the increase in the interest rates triggers an increase in interest expenses in the short run. However, the depositors are running off to other asset classes with higher yields, paying back the outstanding loans and returning the interest expenses to balance.

-

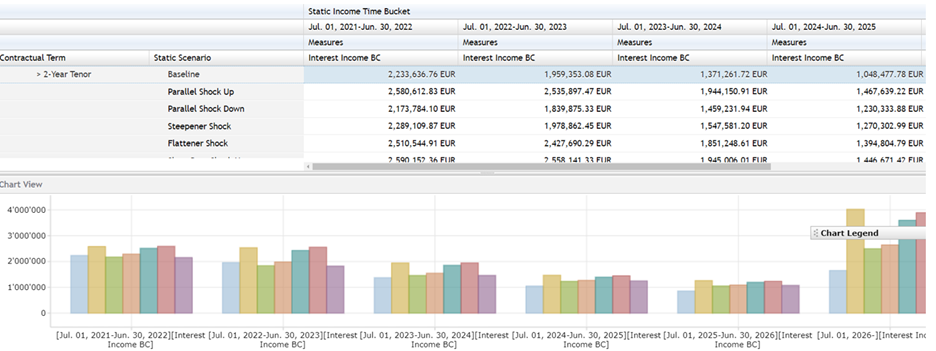

Movements of IR (IRRBB) and credit spreads (CSRBB)

-

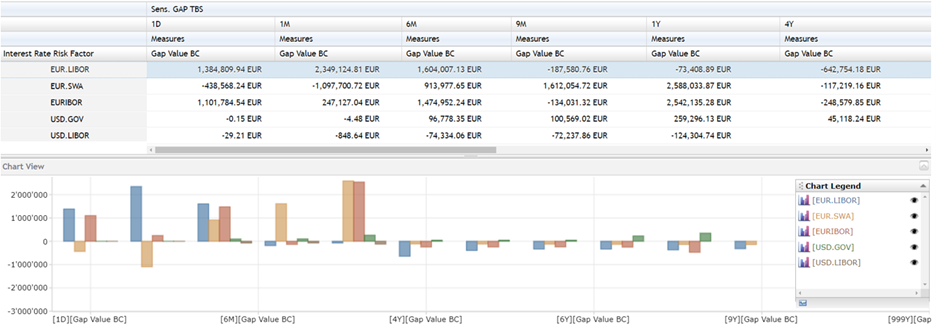

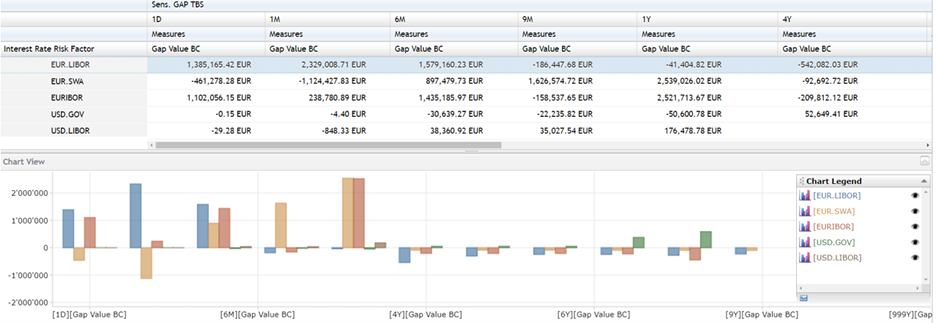

Sensitivity GAP reports driven by the parallel shock-down scenario

-

Evaluate cash flows that are conditional and unconditional to interest rate movements

-

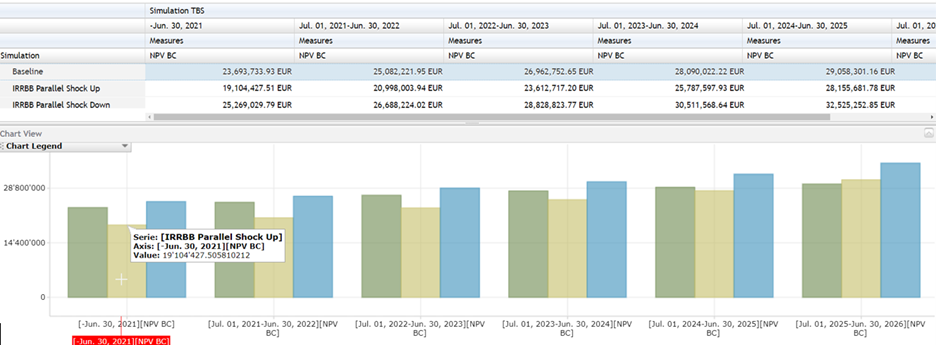

Economic value (EV) and Economic value of equity (EVE) measures on a dynamic balance sheet

Strategies for future business expectations and Economic value (EV) and Economic value of equity (EVE) measures on a dynamic balance sheet.

In figure 7, we can see the impact of the scenarios in the banking book on balancing accounts for the first-time bucket. The evolution of the economic value (i.e. dynamic balance sheet) can be seen through all simulation time buckets under all three selected scenarios - the baseline, the parallel shock up and the parallel shock down.

The benefits of one system for internal and regulatory compliance

Many banks are still using Excel-based systems rather than a specialist ALM system. They are also often using separate systems for their internal and regulatory obligations leading to potential problems with consistency. Institutions will need to be able to model the new requirements but also be confident that they are well positioned for any future changes given the increased emphasis on interest rate risk and liquidity.

Adapting a bank’s internal models to address the new EBA standards is likely to be more complex, risky and expensive. Adopting the standardized method will reduce cost over time and has the added benefit of increasing confidence with many stakeholders, including regulators.

One system for internal and regulatory compliance lowers total cost of ownership and provides simplification.

The importance of a single data layer

Banks need a solution that integrates financial risk and regulatory metrics including the capacity for repricing gaps and sensitivities, applies EBA Standardized Interest Rate Shocks calculations, facilitates the EBA Standardized Approach for EVE and NII calculations as well as the EBA Simplified Standardized Approach for EVE and NII calculations.

A single data source ensures consistency which is vital for accuracy and reliability. It enables banks to build scenarios and projections within a single framework, working at contract-level calculations.

A robust, institutionalized system will provide future protection against further regulatory reforms. It will also enable interactions with, and cross checking of other regulations such as Liquidity Risk, FinRep, AnaCredit and COREP.

Over 60% of the Wolters Kluwer poll* respondents reported that reconciling IRRBB reporting with FinRep, Liquidity, AnaCredit will be challenging.

Conclusion

IRRBB regulations deadlines are fast approaching, and the current, volatile environment further adds to the imperative for banks to ensure their interest rate and liquidity risk systems can manage. Wolters Kluwer can help banks address these business and regulatory challenges. OneSumX clients will be able to manage IRRBB with an integrated solution for both internal financial risk and regulatory metrics. They will benefit from full scenario projection capabilities, a single data source, and reporting functionality ensuring they are managing value, revenue, and profitability across the full balance sheet.

*Wolters Kluwer poll surveyed 182 respondents on 04.04.2023.