Pharmacy deserts: Industry trends drive consumer worries

Data from Wolters Kluwer Health’s third Pharmacy Next: Health Consumer Medication Trends survey reveals how increasing drugstore and retail clinic closures, as well as other industry changes, have American consumers worried about accessing affordable prescriptions.

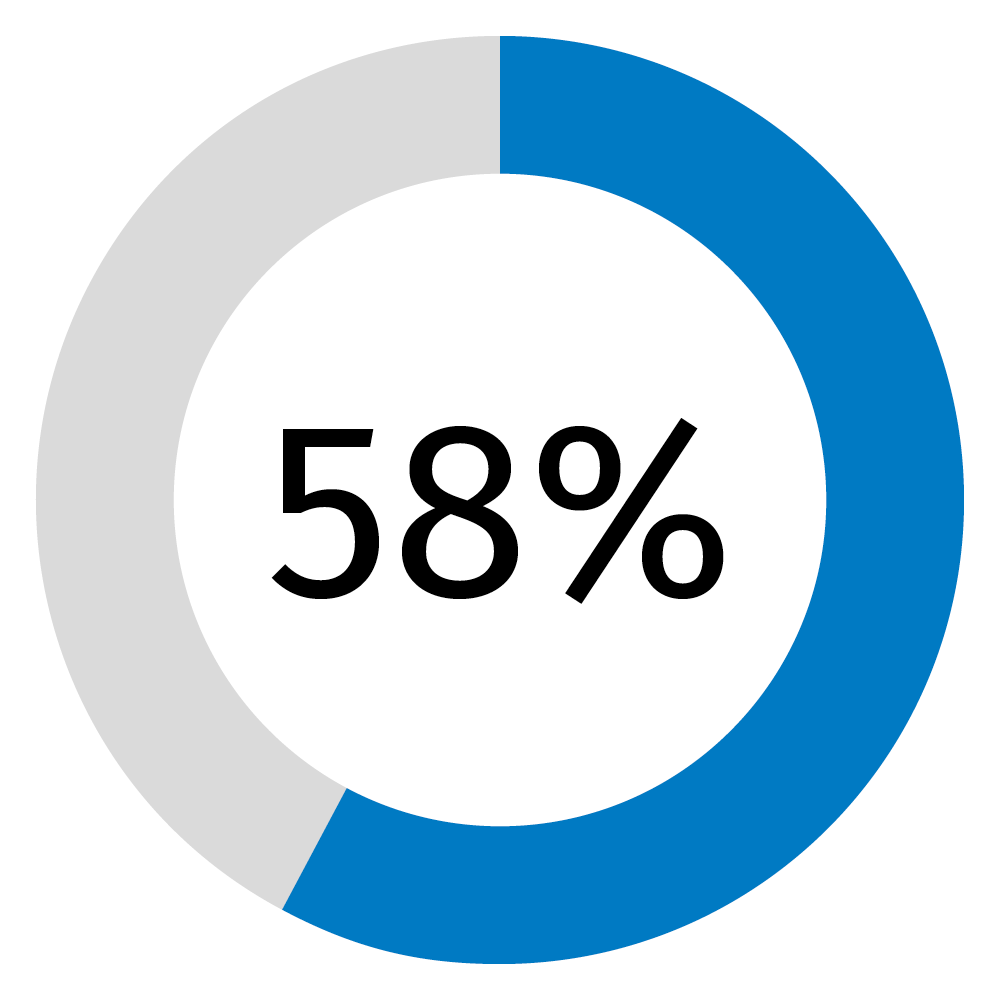

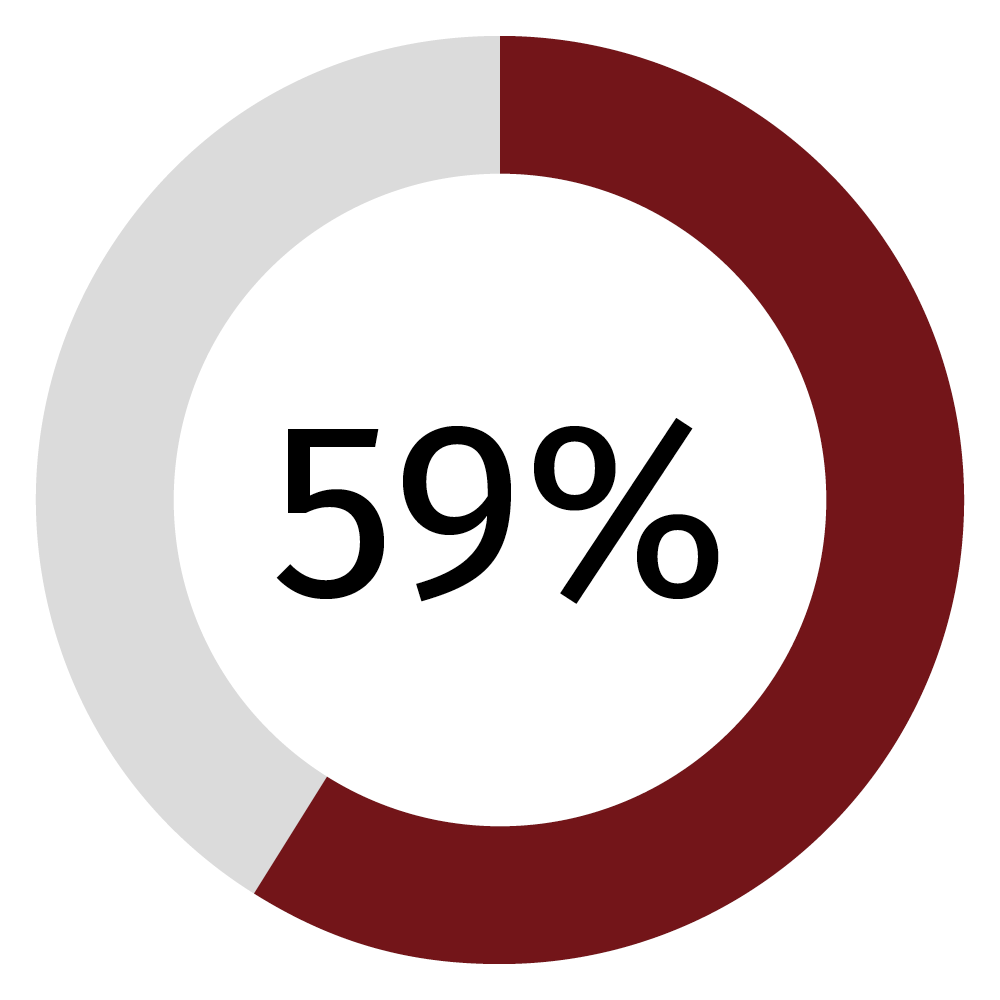

Chain drugstores like CVS, Rite Aid, and Walgreens have announced a combined, estimated 2,600 store closings. Americans are anxious: 59% of survey respondents worry about obtaining medications close to home. Even with internet mail-order pharmacies and pharmacy benefit managers (PBMs) serving as alternatives to brick-and-mortar pharmacies, only 16% of those surveyed prefer using online pharmacies, signaling an undiminished demand for in-person care options as more stores close.

The survey also found other impacts to Americans’ care and medications. Drug shortages are hitting home with 32% of respondents saying shortages have affected their ability to access prescriptions. To help manage medication costs, 44% of Americans report turning to prescription coupon sites like GoodRx, suggesting consumers are more actively seeking ways to control how much they spend on prescriptions.

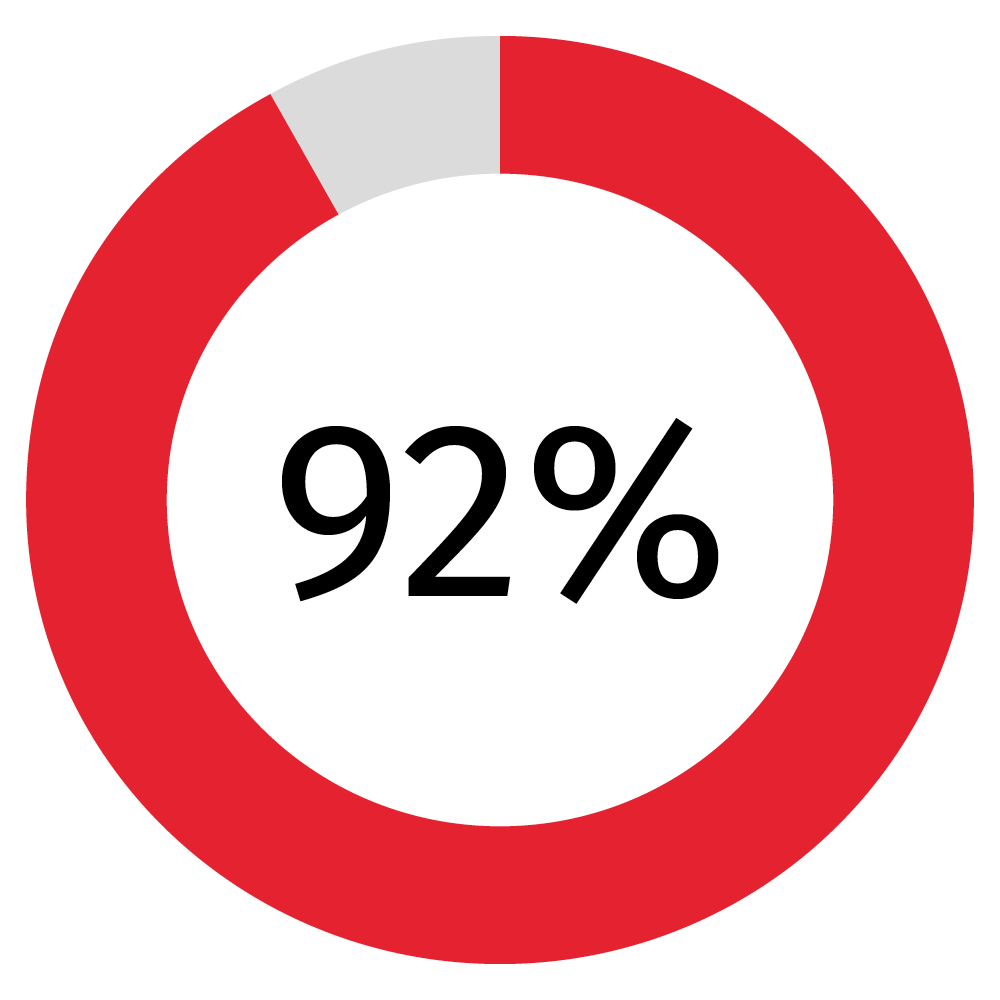

Americans are looking for ways to help manage multiple medications, including new tech. Three out of four Americans (74%) are open to QR codes or links to online information instead of multiple-page medication information printouts. Americans are divided about using AI chatbots for medication questions, with less than half (48%) being receptive. Lastly, Americans are not quite ready for drones for medication deliveries, with only two in five (39%) open to “drugs by drone.”

Explore many more critical insights and findings from our latest Pharmacy Next survey.