With fully digitized banking gaining common usage digital banks are now part of APAC’s emerging financial landscape. As managing compliance risks is tricky, those seeking to enter the market and existing digital banks will need quick and secure way to compliance while staying strategic in the long run. The expectation from regulators for all banks is to adopt more systematic, streamlined approaches in risk management and regulatory compliance.

Banks relying on in-house builds must be mindful of reputational & noncompliance risks that arise from lack of expert knowledge and longer-turnaround time in development. A recent article from APRA pointed out that organizations without systems in place to manage compliance risk is exposed to devastating outcome as “Recent high-profile compliance failures show that failing to manage compliance risk can cause severe financial and reputational damage[1]” which includes paying record fines, and board chairs and CEOs being forced to resign.

A white paper from the Boston Consulting Group (BCG) published in June 2021 titled “Emerging Challengers and Incumbent Operators Battle for Asia Pacific’s Digital Banking Opportunity”[2] noted Asia’s digital banking realm saw continued interest and was home to 20% of global digital challenger banks. It named five key markets in Southeast Asia which offered fertile growth coupled with “encouraging demographics”.

Three factors are critical for digital banks to succeed; the success depends on their capability to quickly build their market share, deploy essential resources to adhere to regulations and compliance guidance, and devise long-term strategies to move the business forward.

Regulatory challenges devour key resources

The above BCG report outlined that “a strong foundation for success is built on the understanding of an often-complex financial industry, including risk management and regulatory requirements. This experience also contributes to an existing pool of transaction data and working credit scoring models which offer an informed starting point”. In fact, a key compliance hurdle is that rules and regulations are in perpetual flux, with numerous new amendments and guidance issued with little notice.

For emerging players starting from scratch, organization structure tends to be lean and stretched. C-suite executives form the organization's backbone, and they are prudent in hiring as headcounts directly affect the burn rate. Often, they do not have the luxury of hiring headcounts dedicated to managing regulatory reports. The person tasked to generate reports for regulators faces ambiguity in the new setup, having to figure out which system to use and whom to approach for relevant data sets, not to mention the steep curve of compliance requirements and fast-changing regulatory and risk obligations.

As a bare minimum, digital banks need smarter ways to utilize data for end-to-end automation of processes. The ideal regulatory and risk reporting system is one with embedded regulatory content that is constantly updated to keep banks compliant at all times. Having a system to take care of the entire process of data translation, validation and enrichment of reporting will free up key personnel so that they can perform value-adding activities to build the business, which they are hired for in the first place, instead of spending time interpreting regulations.

In-house support is sometimes problematic when one cannot find the right staff. In a hiring market where FinTech and RegTech expertise is currently at a premium, the right personnel is difficult to identify, recruit and retain because the field is relatively new and those with the right skills and experience have seemingly boundless opportunities. Digital banks should therefore focus resources on building their businesses instead of interpreting regulations and ensuring compliance.

Cloud technology is a great enabler for streamlined reporting as digital banks need scalable systems to grow their business needs over time. They may consider the rising trend of software as a service (SaaS) for purposes of cost control, as well as the attendant security issues they will face with an on-cloud model.

Growth makes money and cost money

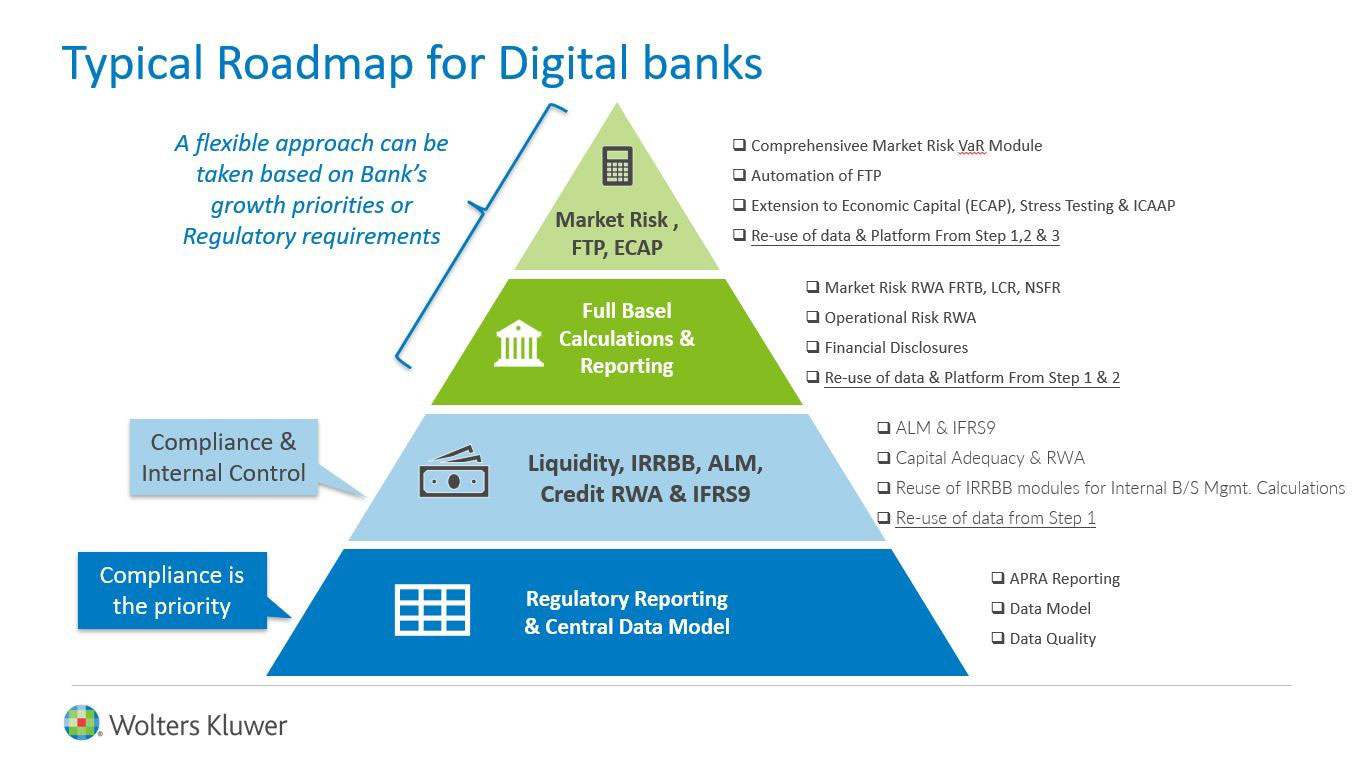

While it is true that compliance is the priority, the roadmap for digital banks goes beyond compliance when they expand their lines of products and complexity of offerings.

Fundamentally, as digital banks offer more products to market, they keep close eyes on balance sheet and interest rate risks, the two main tools for banks to discern their cost of fund. Instead of having a myriad of data sitting in different sources, a single view of automated, streamlined data allows the bank to manage interest rate risk and balance sheet and therefore understand sources of profitability to further optimize business strategy.

As digital banks continue to grow, adding more derivatives and credit products, they will require a more sophisticated engine for risk and finance calculation. Customisation of these systems could result in an insurmountable upgrade challenge if the banks started with siloed point solutions that initially cater to only regulatory reporting. Given the initial constraints of budgets, resources and timelines, digital banks should invest in modular and light solutions which can scale up with size and complexity. Such modularized and productised configuration and updates for Reporting Rules enable upgrades to be executed relatively more quickly and less costly.