Speed and capital efficiency

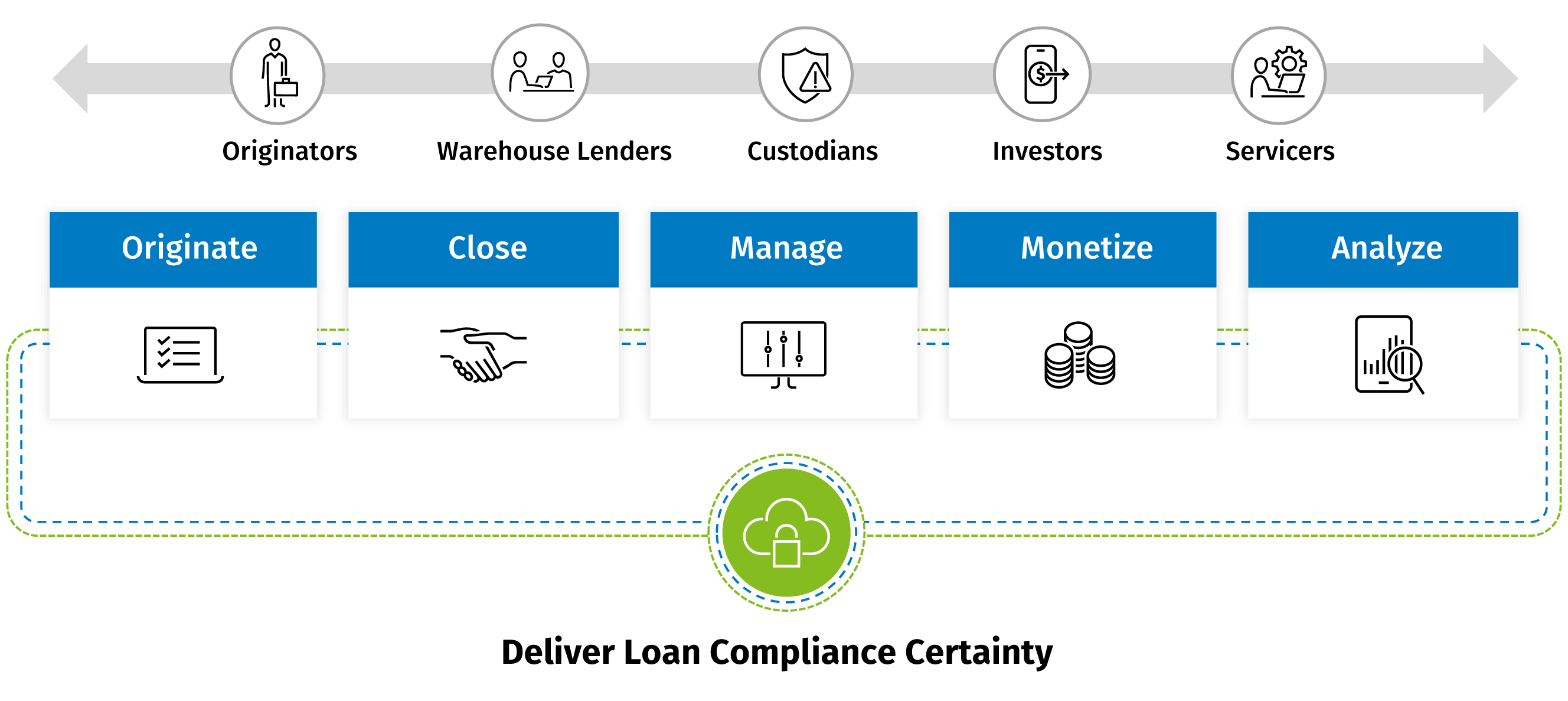

eOriginal accelerates the rate at which digital financial assets are closed, collateralized, securitized and sold into the secondary market – fueling greater capital efficiency and leverage.

Visit our global site in English, or select an alternative location or language below

eOriginal accelerates the rate at which digital financial assets are closed, collateralized, securitized and sold into the secondary market – fueling greater capital efficiency and leverage.

Latest expert insights

Resources