Amid the pressing need to address climate change, financial institutions and organizations are increasingly incorporating Environmental, Social, and Governance (ESG) factors into their overall strategic planning, risk management, and reporting procedures. However, the journey towards effective climate risk assessment and reporting is not without its challenges as well as opportunities for learning.

By the end of the year, financial institutions will be obligated to provide more comprehensive reports on climate and environmental disclosures, including ESG Key Performance Indicators (KPIs) and Pillar 3 climate risk disclosures to the European Banking Authority (EBA). However, several gaps persist such as the need for thorough materiality assessments of banks’ exposures to climate and emission risk, the establishment of robust data governance, and the development of effective approaches for risk assessment and quantification. In this article, we explore practical approaches for successfully evaluating, managing, and reporting on climate risk.

Climate and energy risk data: More does not always mean better

There’s been a significant increase in the number of banks disclosing their climate and energy risks, from 36% in 2021 to 86% in 20221. However, the quality of data provided by these systemically important (SIs) banks has been found to be lacking. According to recent findings2, only 6% of institutions disclose all the necessary information outlined in the reference framework established by the European Central Bank. Many gaps remain relating to, among other things, the lack of robust materiality assessments of banks’ exposures to climate & emission risks, the development of appropriate data governance and risk quantification approaches, performance and risk appetite indicators, limits and thresholds, and climate risk stress-testing frameworks. It is therefore crucial to recognize that data quality is just as important as data quantity when it comes to climate risk assessment. Combining and comparing multiple internal and external datasets, as well as best practices, is the best way to overcome this data quality hurdle.

Disclosures reporting: Ramping up delivery

As central banks, including the European Central Bank (ECB), push for improved climate risk reporting, financial institutions will be expected to provide more detailed and higher-quality carbon and emission data over time. However, at the moment, as per the ECB, external stakeholders are not given adequate information on how banks could be affected by climate and emission related risks.

The process will likely be gradual, but the bar will be raised, nonetheless. Data needs to be collected, centralized, and curated before it can be used to manage ESG risks and for regulatory processes. High quality data is essential in having a consistent view across dimensions and departments. Therefore, to navigate the evolving landscape successfully, financial institutions will need to take a two-pronged approach: (a) work with a trusted partner and build a scalable platform, and (b) have an adaptive mindset that embraces experimentation and change as natural parts of the journey.

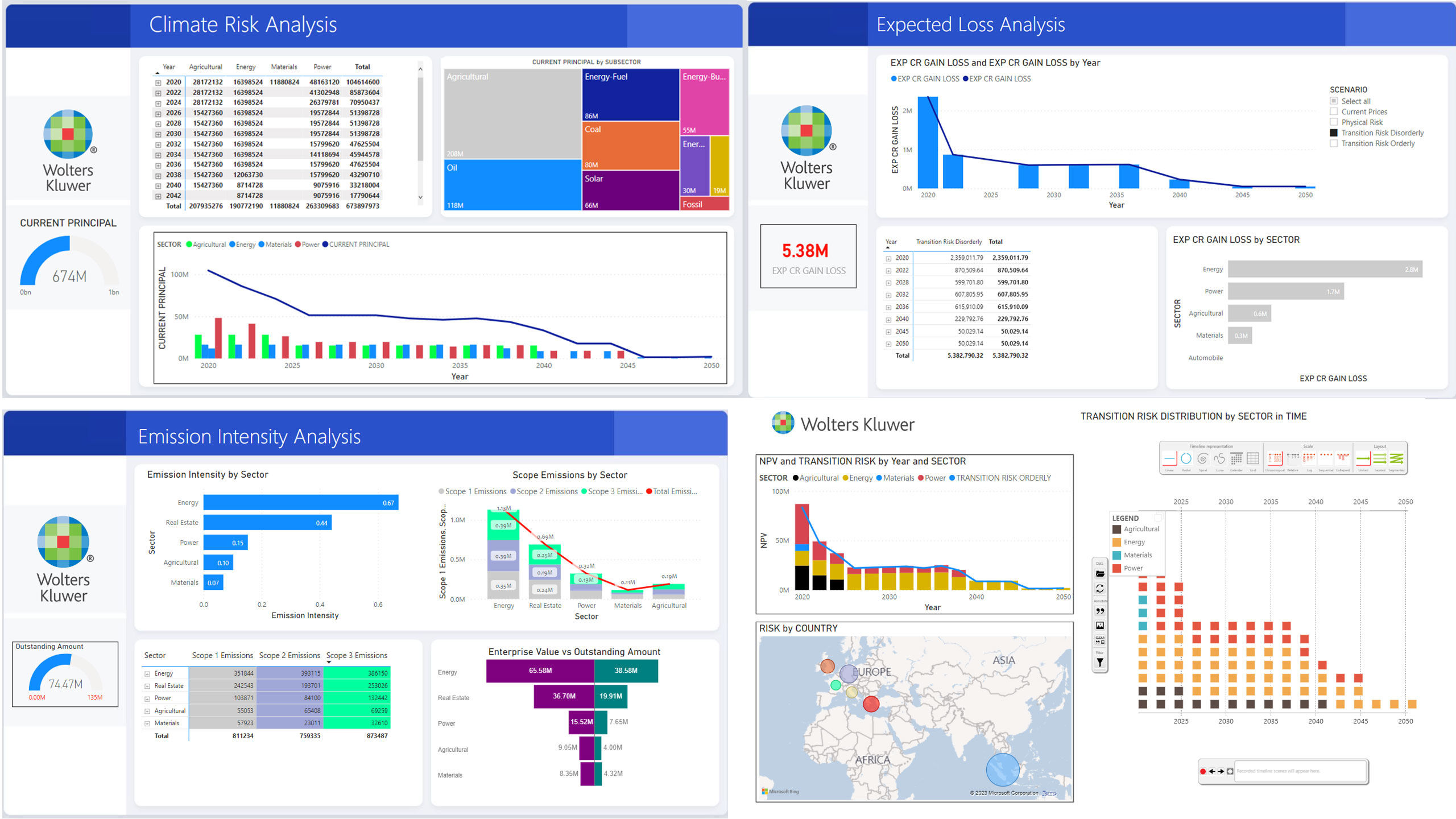

Climate scenario assessment: Top-down and bottom-up

Currently, most organizations follow a top-down approach. Such an approach allows for the identification of structural ways to address climate risks using existing mechanisms, although the specifics can vary across regions and sectors. Central banks, for instance, provide climate adjusted macro-economic variables but might require financial institutions to adopt more comprehensive approaches.

Simultaneously, experimenting with bottom-up strategies for key sectors and regions enables a more nuanced understanding of specific challenges and opportunities. In the future, we can expect a gradual shift in the approach of financial institutions as they increasingly adopt a counterparty-specific approach. By focusing on individualized and detailed assessments, financial institutions can enhance their overall risk management and decision-making processes.

Data benchmarking: Reconciliation and averages are key

The abundance of climate risk data can be overwhelming. While amassing vast amounts of data is a good starting point, it is crucial to set up reconciliations between different types of data, such as climate risk ratings. Benchmarking this data against sector averages or portfolio averages over time can provide valuable insights into its stability and suitability for your organization. Reconciliation and averaging help in deriving actionable insights from the wealth of climate risk information available.

Climate risk challenges: No silver bullet (yet)

Although progress has been made, further convergence is necessary in the field of climate risk assessment. The current landscape remains primarily driven by principles rather than a global standard. While a globally recognized standard would be beneficial, it is crucial for policies and leaders to align their efforts first. Acknowledging that no single solution will solve all climate risk challenges, organizations should remain open to future policy convergences and changing benchmarks.

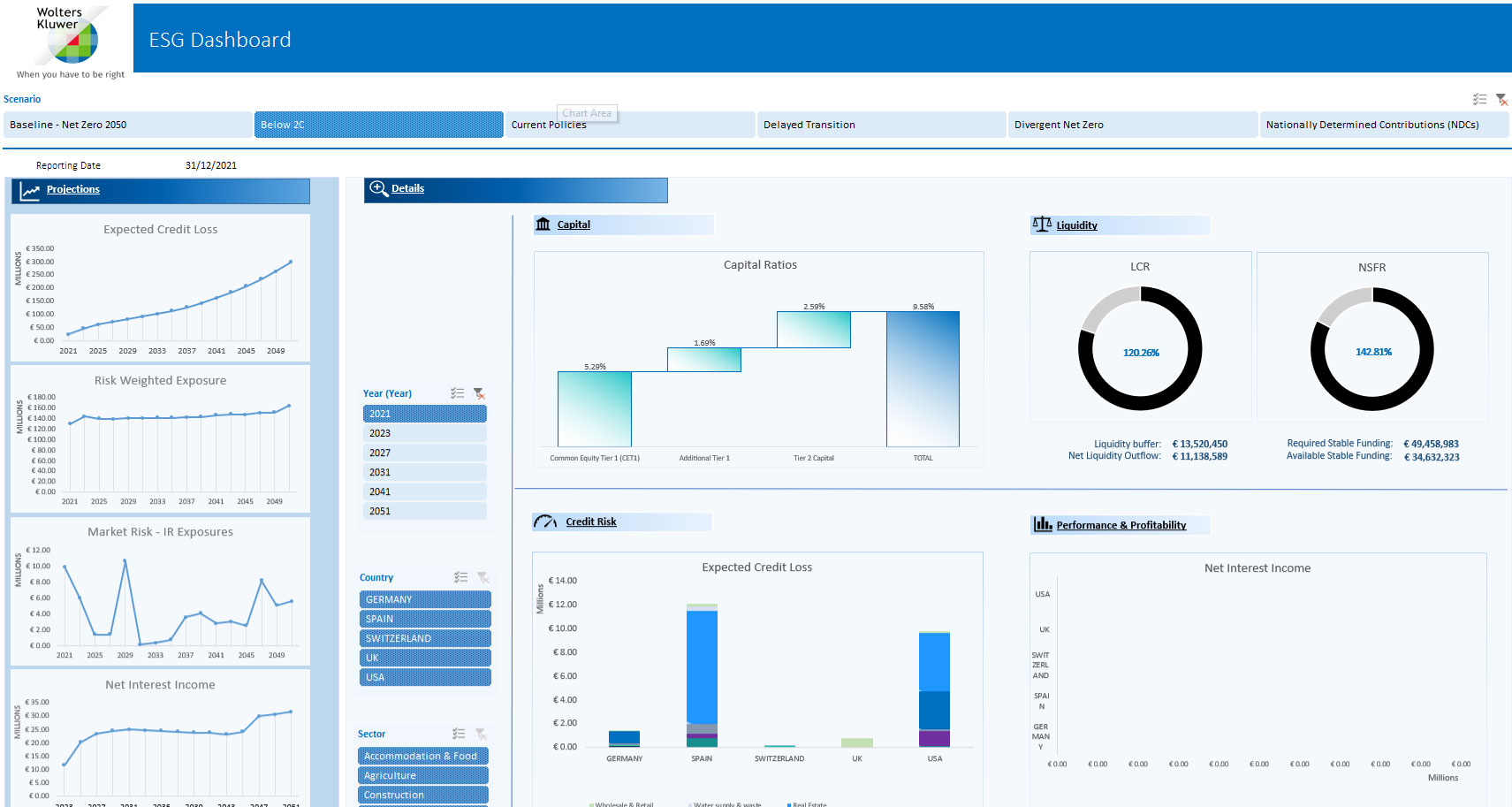

Building a sustainable future: Connecting the dots

As climate change continues to shape the business landscape, climate risk assessment is becoming increasingly crucial for organizations across various sectors. By laying a solid foundation, identifying strategic priorities, embracing change, and staying informed about policy developments, organizations can navigate the complex landscape of climate risk assessment effectively and make informed decisions that contribute to a sustainable future. At Wolters Kluwer, we have the expertise and tools to help financial institutions manage ESG risks, meet regulatory requirements for EBA Pillar 3 and CRR3, and support your sustainability efforts. How can we help you?

1 & 2 https://www.bankingsupervision.europa.eu/press/pr/date/2023/html/ssm.pr230421~213bf10fbe.en.html