Preparing for CRR3 supervisory reporting and Pillar 3 disclosure requirements

Crafting the final supervisory reporting and Pillar 3 disclosure rules based on CRR3 has been a painstaking and seemingly interminable process for financial authorities and the institutions that answer to them. Requirements have been continually changed or left uncertain or unclear, and deadlines have been pushed back.

But terminate it must, and soon. The deadline to implement the Banking Package – Capital Requirements Directive VI (CRD VI) and Capital Requirements Regulation 3 (CRR3) – is 1 January 2025, earlier than in some other jurisdictions. That remains firm, even as the European Banking Authority (EBA) continues to refine the requirements.

If you are behind schedule in your preparations, you certainly are not alone. Many institutions decided, for quite understandable reasons, to hold off on a full commitment to their implementation plans. A Wolters Kluwer Financial Services survey from December 20231 found that only 6 percent of institutions had started implementation of their Basel projects and 25 percent had not even made a start. The rest had made some intermediate measure of progress. With ten months to go, the time for dither and delay is over – financial institutions cannot afford not to be compliant! Here we discuss how banks can put CRR3 into practice most effectively to meet the deadline and then to live with the new requirements once they are in place.

EBA’s two-step path of amending and clarifying requirements

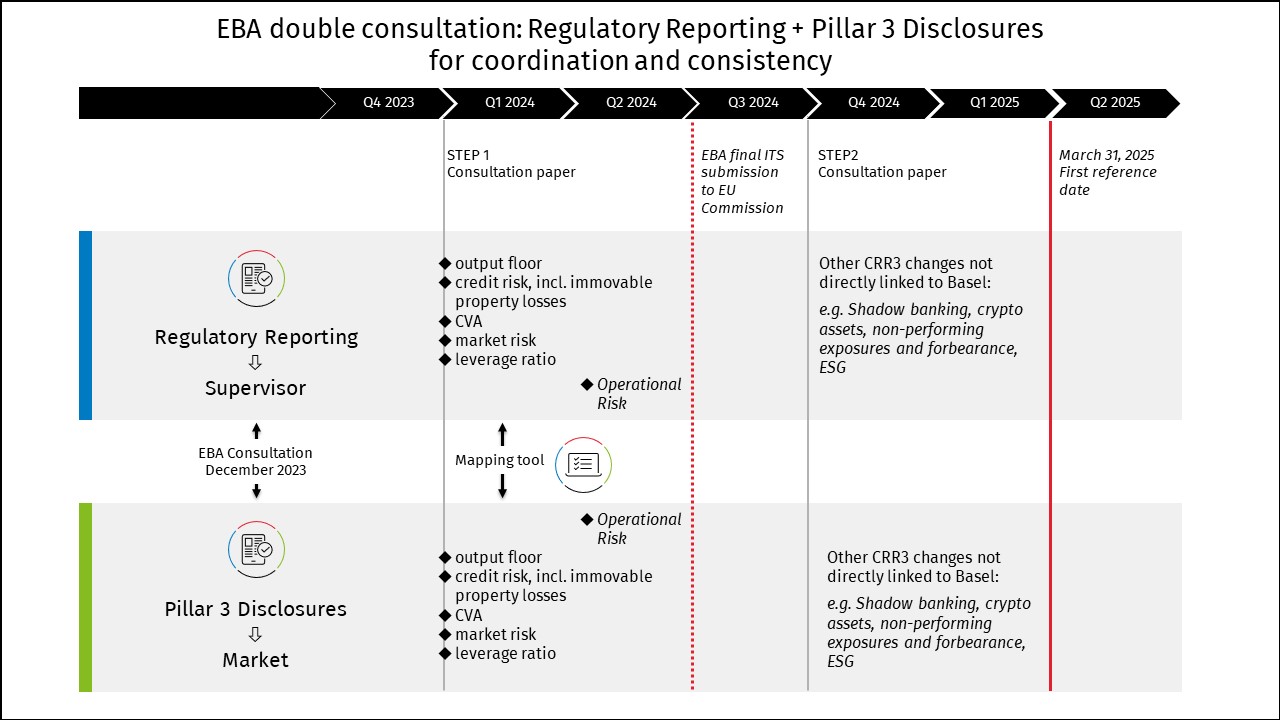

Basel metrics are a series of analytical rubrics designed to assess a bank’s risk more accurately by making calculations in greater detail and emphasizing the influence of each risk on others. Having established the framework’s key elements, and with the implementation deadline drawing near, the EBA is turning its attention to finetuning the rules that institutions must follow to comply. The authority is seeking industry input, via two consultations due to run through mid-March, one on amendments to the implemented technical standards (ITS) on Pillar 3 disclosures and one on supervisory reporting. The EBA will submit amendments to the European Commission for approval, around the start of the third quarter, to have them apply beginning January 01, 2025, with the first reference date of March 31, 2025, aligned with the application of the CRR3. Further, the EBA will also develop the data-point model (DPM), XBRL taxonomy, and validation rules based on the final draft ITS.

The EBA will follow a two-step sequential approach to amend both the Pillar 3 disclosures and supervisory reporting ITS, prioritizing, in step 1, those changes necessary to implement and monitor Basel III requirements in the EU. Later in 2024, as part of step 2, the EBA will develop those reporting and disclosure requirements that are not directly linked to Basel III implementation, together with those requirements with an extended implementation timeline. To facilitate integration, consistency, and alignment between reporting and disclosure requirements, the EBA has developed a mapping tool consisting of a comprehensive set of Excel sheets. These sheets enable the mapping of most quantitative disclosure templates with the relevant reporting data points.

Those changes that are covered in Step 1 are brand new to the Basel process. The EBA has prioritized them to ensure banks have enough time to collate the data points and prepare for the first application of reports that are based on the March 31, 2025 data.

In particular, this draft ITS seeks to implement changes related to the output floor, credit risk, including immovable property (IP) losses, capital valuation adjustment (CVA), market risk, and leverage ratio. This ITS also includes the changes to the boundary between the trading book and banking book that will affect all banks. The amendments related to the new operational risk are not covered by these consultation papers but will be consulted on together with some policy products in early 2024.

Navigating reporting challenges

As highlighted above, banks will need to focus on the newly introduced Basel elements as they have no prior experience or reference data available.

Credit risk, market risk, and leverage ratio changes will affect all financial institutions. Whether or not the reporting requirements apply to a bank will be dependent on the use of internal models for regulatory purposes (output floor), and business activities (CVA with three possible methodologies depending on thresholds).

With changes to reporting procedures, financial institutions must ensure that the applications responsible for computing the required metrics can effectively furnish all necessary data points with the required level of detail. Identifying such shortcomings early on is crucial, as implementing the required changes may demand a substantial amount of time. These examples underscore the granularity of reporting modifications:

- The implementation of the Basel III finalization (aka Basel IV) introduces a significant shift in reporting requirements, in particular the output floor. Template C 10.00 now mandates institutions to disclose Internal Ratings-Based (IRB) exposures subjected to the output floor. This disclosure should be detailed, breaking down the exposures by Standardized Approach (SA) exposure classes. The report should encompass the key steps involved in the calculation of standard risk-weighted exposure amounts, providing insights into both standardized and internal model results. It is crucial to emphasize that generating this level of granularity may not be readily available and necessitates immediate control measures. This obligation extends across all entities within the group and is explicitly outlined for each entity in the Group Solvency Information on Affiliates (C 06.02). Swift attention and adherence to these reporting intricacies are imperative.

- Mortgage exposures secured by immovable properties are now categorized into nine new classifications, reflecting changes in both the credit risk report (C08.01, C09.01) and own funds requirements (C02).

- The Credit Conversion Factors (CCFs) have undergone modifications under the CRR3, introducing new rules that impact the scope of computing estimations of CCFs and the calculation methodologies. This is reflected in new columns in both the credit risk report (C08.01 and C08.02), along with the reporting of differences between modeled and standard CCFs.

- Additionally, for securitization, compliance with the regulation mandates the inclusion of a new "unique identifier." This requirement serves as an example of a data point that might not be readily available at present.

Looking ahead: Next phase of the EBA consultation

The second step focuses on elements of the Banking Package that are not directly related to the new Basel elements. These include reporting about shadow banking, crypto assets, non-performing exposures, and forbearance, along with reporting requirements related to environmental, social and governance factors (ESG), which continue to be a work in progress. Implementation timetables for Step 2 elements are likely to extend beyond March 2025.

EBA is giving particular attention to the coordination and consistency between supervisory reporting and pillar 3 disclosures, as testified by the simultaneous issuance of the two consultation papers. This is not only aimed at ensuring consistency, but it also contributes to minimizing the banks’ cost of compliance and fits with the Pillar 3 data hub project in an ambitious framework. Therefore, banks need to coordinate pillar 3 disclosures and supervisory reporting programs and leverage the EBA mapping file.

The foundations underpinning a successful project

When setting priorities and executing your implementation project, the EBA’s Step 1 should be yours, too. An institution can develop an impeccable plan for implementing CRR3, but it can only execute it effectively, and on time, if it has the right technology and team backing it up. As everyone knows, these EBA Step 1 and 2 are not the only changes, more will come, and definitely in the new areas such as ESG. Managing a complex and continually changing framework like CRR3 requires an integrated data solution with a capable, well-regarded and trusted partner providing a regulatory update service. Together these key pillars of support offer two critical features: the consistency in results that supervisors demand and the ability to see risks from all angles, which is essential given the emphasis on interrelationships among risk sources.

With less than a year to go, your institution cannot afford to miss compliance deadlines. Following the steps outlined here will keep you on track and help you manage your CRR3 compliance challenges.

* A survey of 200 bank attendees from our 2023 Q4 FRR Quarterly Webinar held on December 23, 2023