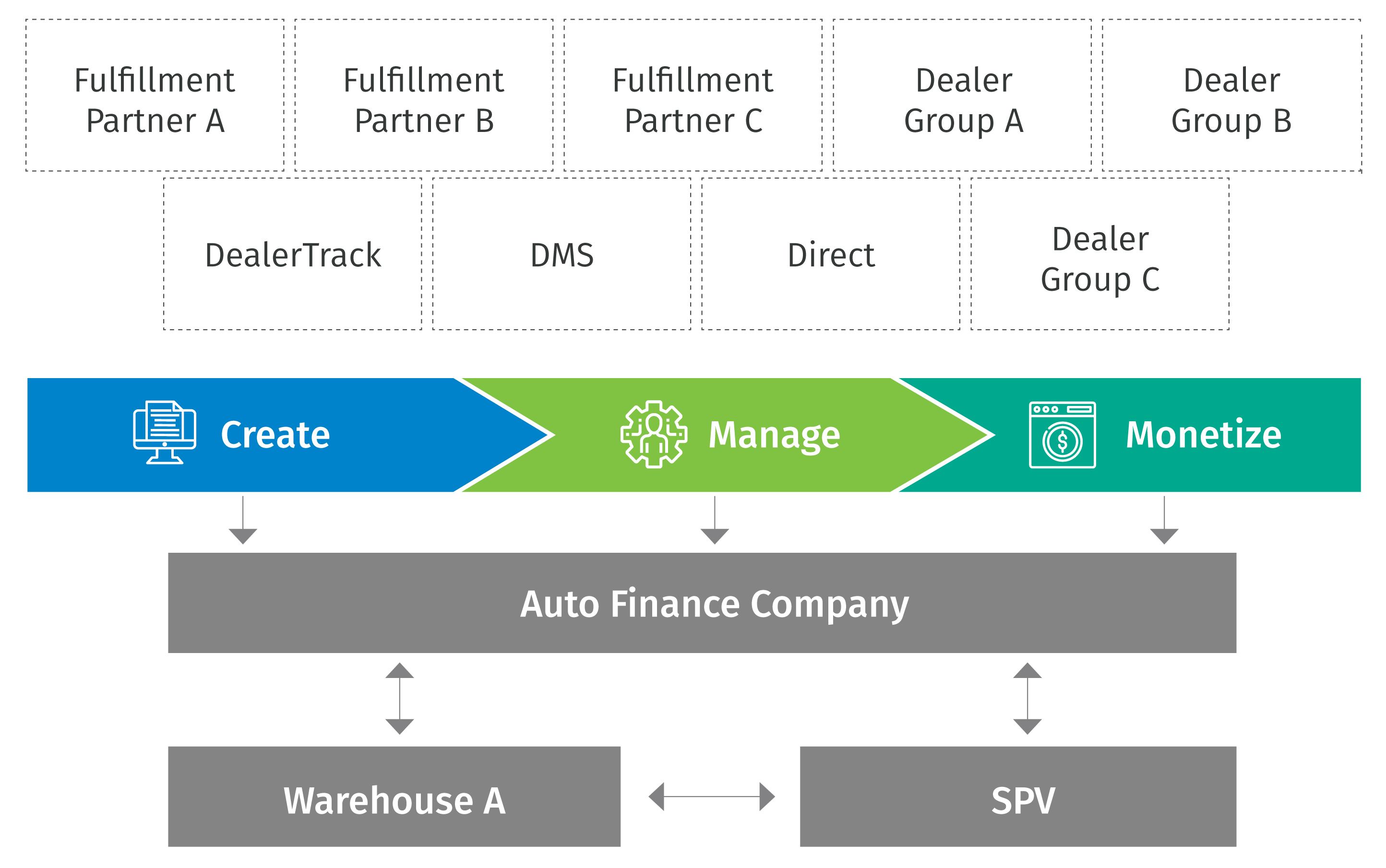

Multi-channel origination entails tracking, auditing, and analysis tasks across a host of digital and analog locations, which could then create operational and business bottlenecks for warehouse lending partners and negatively impact transfer and securitization for secondary market delivery.

Leading auto finance providers are finding themselves increasingly in need of agile technology systems that enable eContracting and post-transaction asset management across an ever-growing array of channels.

Reduce operational and time costs with OmniVault

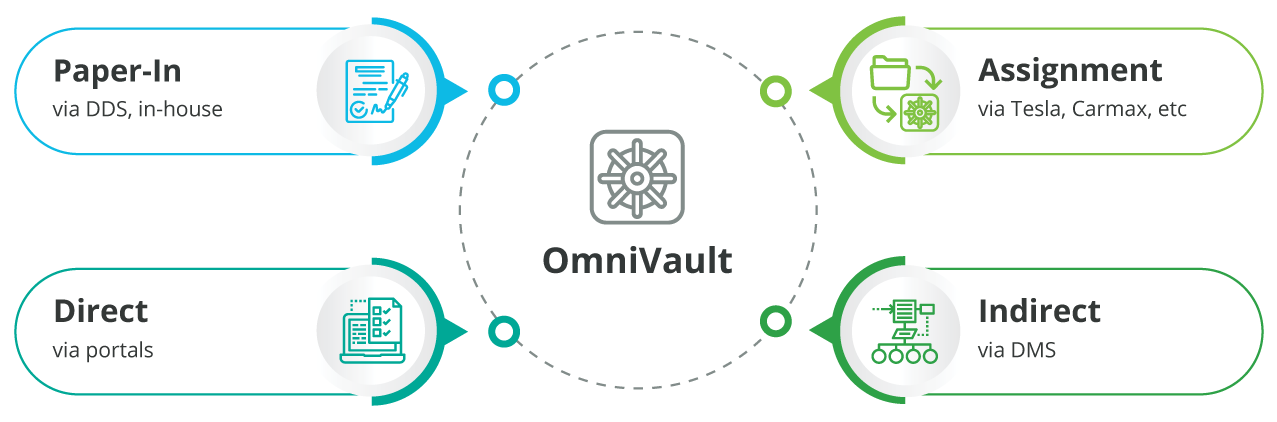

Built on a foundation of the industry-leading eOriginal lending platform, OmniVault is an ecosystem purpose-built to handle the auto finance industry’s origination channel diversity, eliminating the complexities around managing various multi-channel assets post-execution, and drastically reducing operational and time costs.

OmniVault allows for improved visibility of assets, quick expansion of the investor and lender pool, agility, and the ability to scale quickly and dynamically.

OmniVault also provides the assurance of legal and regulatory compliance, enabling lenders to securely manage digital assets throughout their entire post-execution lifecycle through an electronic collateral control agreement (ECCA).

ECCAs are unique and proprietary to eOriginal, in which a tri-party agreement is created to provide protection to the bank or secured party for funds lent to originators or debtors. The ECCA addresses legal concerns surrounding eChattel, and serves as best practice for all types of loans digitally.

Enjoy rapid secondary market deliverability through OmniVault’s asset management

OmniVault offers centralized data management across an entire portfolio, allowing lenders to view metadata across various origination channels and asset classes.

This enables lenders to control and track access, manage status changes, and transfer control of Digital Original™ documents – which provide the highest levels of protection and compliance available in the industry – and utilize OmniVault’s granular controls and permissions to allow for departmental separation and visibility.

With this platform’s level of control and management, lenders see improved speed and capital efficiency, freeing up capital through syndication, sale, or securitization.

Various assets can be managed, pledged to a trusted third party, or pooled for sale or securitization into the secondary market with an immutable chain of custody.