The pressure is building

In under two years, authorized deposit-taking institutions (ADIs) in Australia have been hit with two major pieces of regulation issued by the Australian Prudential Regulation Authority (APRA): revisions to the capital framework, and the ARS 220 reporting standard for credit risk management.

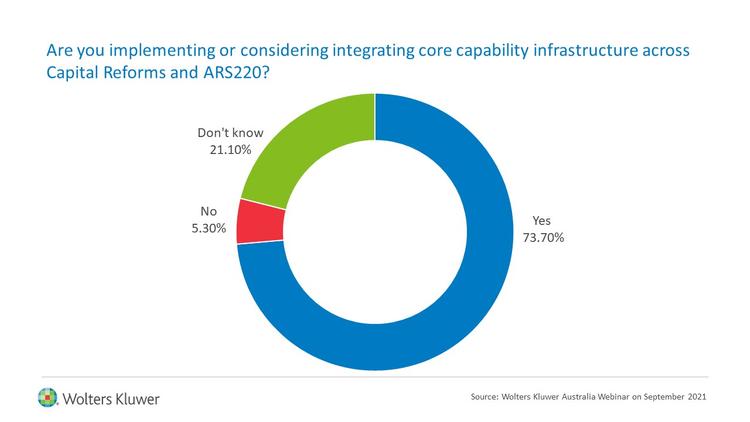

The former will bring capital reforms and a string of new standards for ADIs, and at the same time place pressure on their internal resources, systems, and data architectures to the point of breaking. The latter, ARS 220, will require more granular data collection and analysis from ADIs as shared in a recent webinar on this topic, and outlined in this commentary.

In addition, other new standards for the banks will continue to impact risk-weighted assets (RWA), large exposure limit (LEL) management, more sophisticated stress testing scenarios, ongoing focus on internal capital adequacy assessment process (ICAAP), new data and insights for environmental, social and governance (ESG) management, market and counterparty risk components – the list goes on.

And if this was not enough, banks need to meet to increasing expectations – the fast pace of change in terms of customer experience, increasing numbers of open data exchanges such as APRA CONNECT, and Open Banking.

No doubt the capital reforms, ARS220, and other standards will all be forcing firms to consider a more data-driven and forward-looking approach to risk management, finance and regulatory reporting. In response, we have seen many approaches to these imperatives and pressures: some are considerable and adaptive; however, most are disparate and short-term with a focus only on compliance.

Banks’ inadequacy to meet challenges

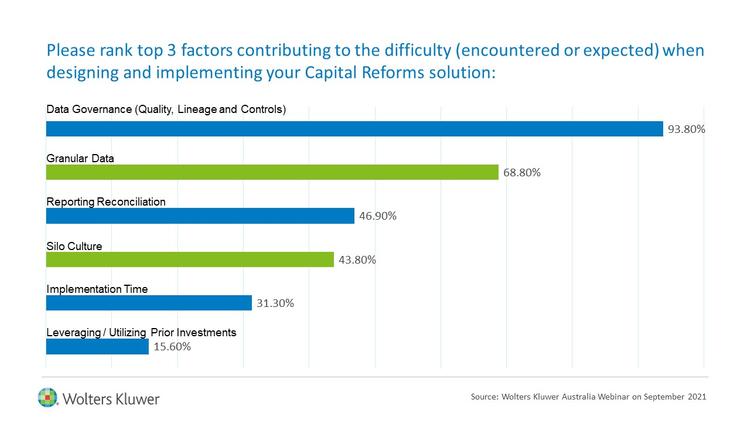

One aspect that the Australian banks seem to agree on is that Data Governance, Quality, Lineage and Controls (93.6%) is the most challenging pressure point when designing and implementing a capital reforms solution, according to a poll in our recent webinar on ADI Capital Reforms. This is also the most important domain to resolve, as the new capital framework will punish poor data quality and management with unfavorable risk weights.

Furthermore, this poll suggests banks in Australia will be severely impacted by the introduction of ARS220 due to data silos and ineffective data management strategies which will impact successful design and implementation of their capital reform solutions; granular data (68.8%), reporting reconciliation (46.9%) and silo culture. (43.8%).

This issue becomes compounded when external research is factored in. According to Gartner[i] predicts that through 2022, less than 5% of data-sharing programs will correctly identify trusted data and locate trusted data sources and found that many organizations still inhibit access to data, preserve data silos and discourage data sharing.

However, while this not a new challenge for financial services – for example, the Bank of International Settlements (BIS) has long held the view that banks need to simplify their risk, finance and regulatory data architectures – it is getting more and more relevant and urgent[ii].

Short-term solutions focused on an incremental, ‘one problem at a time’ approach does not work and only amplifies several issues. It inhibits the agility of banks, an exacerbates inefficiencies produced by silos. Work is more likely to be duplicated with several departments each producing the same information often in different ways and with different results. This in turn over-complicates reconciliation, compliance, and business leverage while increasing costs to manage and/or change.

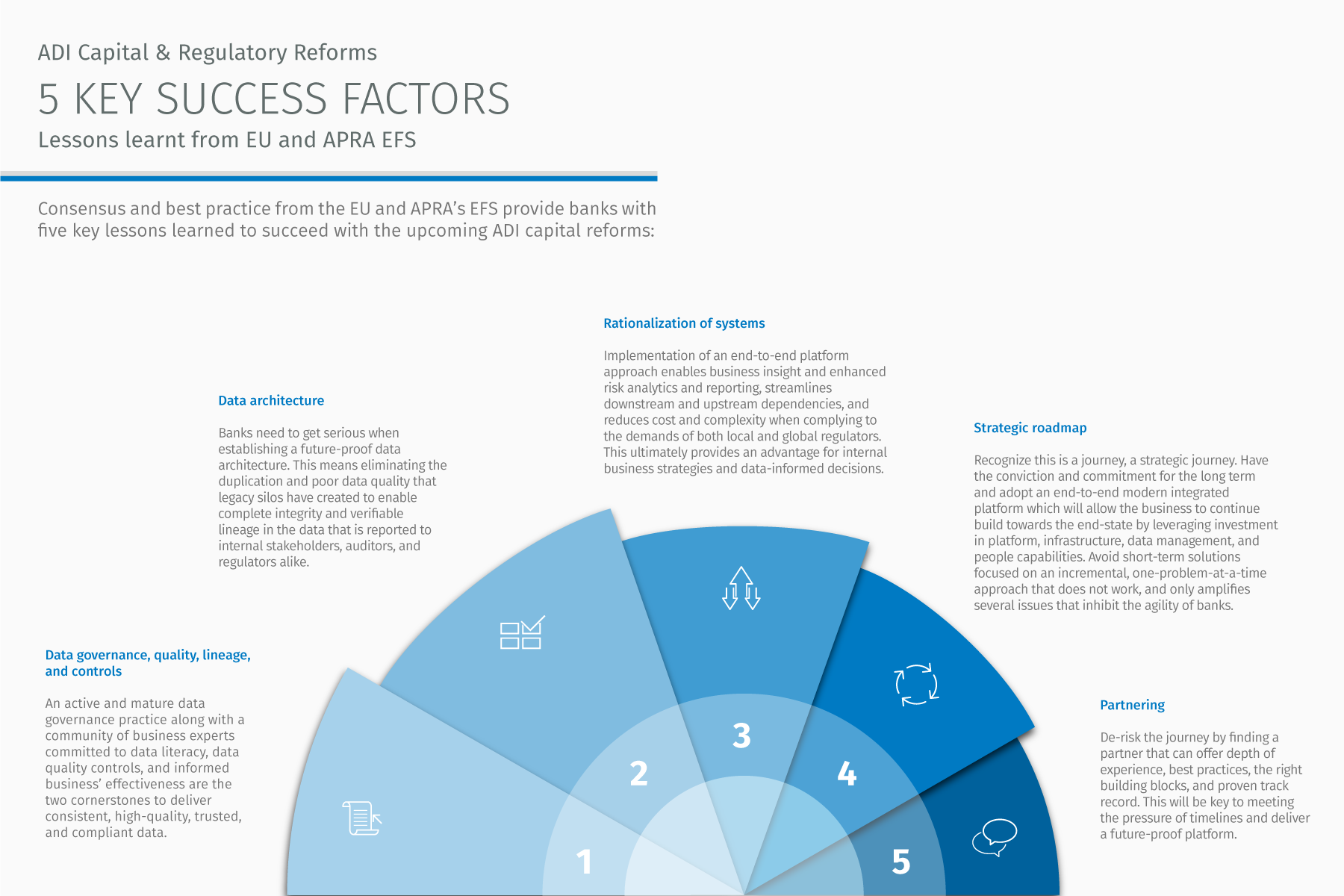

BIS continues to urge banks to rationalize systems and data repositories to establish a future-proof data architecture. Banks need to eliminate the duplication that legacy data silos have created following the implementation of many ‘best of breed’ solutions. Once this is done, they can have complete integrity and verifiable lineage in data reported to the internal stakeholders, auditors, and regulators alike.

The Question remains “is there an efficient way to get there?”

Despite the seismic shift in expectations, pressure points, and despite the many complexities of legacy systems, these regulatory changes can be underpinned and synergized with the right approach to optimizing resources, data, and systems architecture. It is always helpful too to look at other regulatory regimes to garner helpful insights.

For example, APRA intends to include capital adequacy reforms (under Basel IV) for credit risk as part of the ARS 220 granular data collection in the future. Fortunately, Australia is not the first jurisdiction to implement Basel IV and granular data reporting.

With ARS220, APRA has likely taken its lead from the European Central Bank (ECB) collection of granular credit and credit risk data, otherwise known as AnaCredit. It has also observed the thematic challenges across the EU and global banks relating to poor data governance and quality management and will expect Australian banks to follow best practice to address these themes more proactively in their solutions.

In fact, Australian banks can gain many lessons from the EU Basel IV and AnaCredit experience on how to efficiently implement the reforms and new standards.

The top 5 EU Response Trends to drive efficiency:

- Data lifecycle approach that spans end-to-end across the business and supports ‘reconciliation-by-design’

- Rationalization of applications to streamline downstream and upstream dependencies

- Consistency driven from a central data repository to provide quality, lineage, and controls consistency for internal, market and regulatory reporting

- Integration is key to support qualified and verified data sharing across Finance, Risk and Regulatory departments

- ‘Always on’ compliance operational, not just reporting compliance

A little closer to home, the APRA Economic and Financial Statistics (EFS) collection introduced in 2019 was a game-changer, and for many, a wake-up call. Following the same trends experienced globally, EFS placed a laser focus on data quality as well as understanding and managing the data flow.

The key lesson coming out of the Australian EFS and global experiences, is that success will be based on implementing an integrated approach to the bank’s data strategy, underpinned by a robust data architecture, business and system architecture, enterprise platform solution approach, with the right investment in the people skills and capabilities, organizational data culture and literacy to support an end-to-end data lifecycle governance and quality management.

The benefits of an end-to-end integrated platform approach

An integrated data-first platform with a trusted centralized source will deliver speed, quality flexibility, adaptability, and scalability that is critical for today’s and tomorrow’s demands.

Banks are leveraging the capital reforms and reporting standards as an opportunity to improve the organization’s overall data and risk management frameworks, not only for credit risk but all areas of decision making across risk, finance, regulatory reporting management and business growth strategies.

By taking this broader holistic approach banks will benefit from a multiplier efficiency effect by creating new insights and levers to influence the way their business operates in relation to pricing, products, profitability and credit decisions on the back of these reforms.

Other benefits include: