One innovation driving many

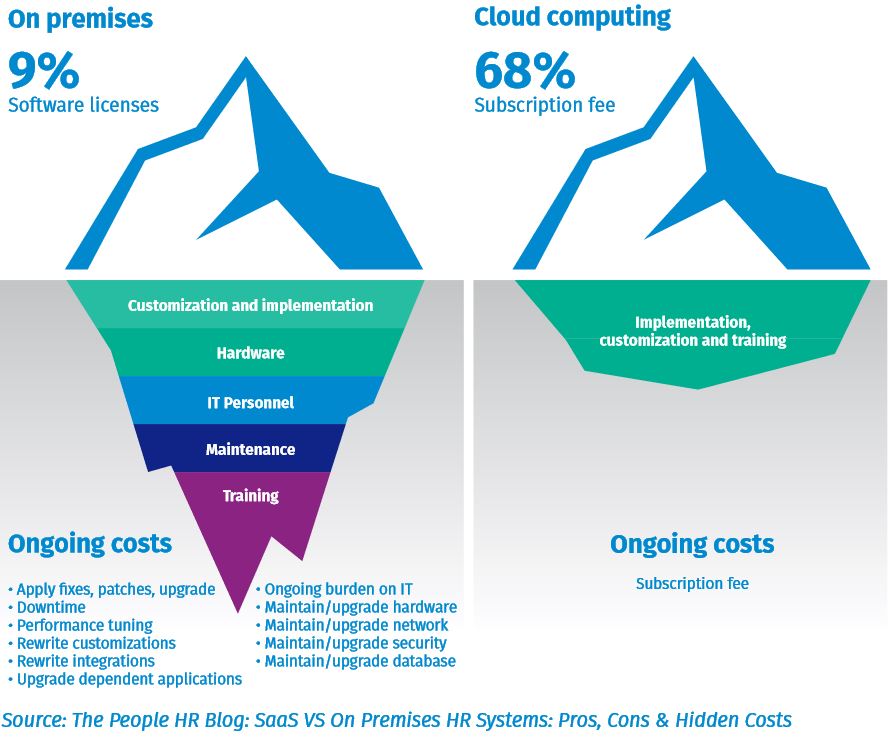

A SaaS model, by contrast, allows firms to treat systems as a quantifiable, all-in-one operating expense, covering licenses, maintenance fees and so forth, that could be lower in the long run than the capital outlay to buy and maintain systems on premises. And they get a lot for their money: Cloud computing, the technology underpinning SaaS, is one of several innovations in recent years that enable financial institutions to boost performance beyond compliance and reporting, enhancing efficiency across the business, and therefore profitability.

Indeed, SaaS optimizes the utility of many of the other innovations. It allows firms to make the most of the latest advances in hardware, such as in-memory computing, that may be difficult to house on premises, especially for smaller firms, such as challenger banks, because of the expense involved and/or a shortage of skilled personnel.

SaaS solutions also facilitate flexibility by allowing institutions to scale up or down through the use of modular hardware configurations, and by adding, updating and subtracting software to meet commercial demands – new business lines, new markets – and demands from regulators, too. When institutions outsource key tasks to a service provider, part of whose job is to ensure that its systems are equipped with software compatible with the latest regulatory updates, information that in-house staff may not always be aware of, they can be more confident in the results they submit.

That last part surely has crossed regulators’ minds. It is

one reason that they are encouraging banks to embrace

software as a service. SaaS solutions permit another

circle to be drawn that supervisory bodies no doubt find

virtuous. The greater adaptability of the hardware and

software, enhanced by the expertise of the specialists who

configure and run it, allows technological advances and

the demands imposed on banks to shape and refine each

other. Regulators know that updates can be incorporated

more readily into systems, and so they make more, and

more complicated, demands.

Supervisory authorities have moved certain items higher

up on their agendas – requests for more granular data; an

ability to grab information rather than ask banks to submit

it; longer, clearer audit trails; more closely integrated

systems that facilitate cooperation among key functions

– in part because they know they are within easier reach

under a SaaS model. The understanding of what regulators

are looking for then drives the development of it.

An understandable but misplaced reticence

Some organizations may be reluctant to try a SaaS

solution. Perhaps, like parents sending their child off

to school for the first time, they are wary of letting their

data out of their immediate control. Security concerns

are understandable, but there is less cause for them

than in the past. Chances are, in fact, that remote servers

and connections are more secure at Microsoft Azure or

Amazon Web Services facilities than at almost any financial

institution. The service providers spend billions of dollars

to make sure that is the case.

There may be no safety misgivings at all behind a

reluctance to migrate to the cloud. Firms could just be

satisfied with their legacy systems. They may have been

designed and installed just for them, and they may serve

their purpose well enough. It could be that some IT

departments fear the impact a SaaS solution will have on

their operations – or on their jobs.

But anyone who works in tech knows that change is

inevitable; it is a hallmark of the trade. SaaS is simply

better at handling change than in-house architecture.

One of the most important aspects of a SaaS solution is

the service contract, with performance guarantees, that

comes with it. No vendor that installs a system on a firm’s

premises and then walks out the door can provide the

same level of commitment, and in-house staff, even in a

large organization, may not be able to fill the gap. They will

continue to play a vital role in the SaaS era, however. The

understanding of their company’s needs will shape the

solution employed and the ongoing relationship with the

service provider, and they will remain involved in matters

such as network security.

No letup by regulators or innovators

Financial institutions face pressure from many directions:

the accelerating pace of innovation, the desire of

regulators to ride that wave and push firms to move to the

cloud, and the need to look for any edge in an increasingly

competitive industry – especially as challenger banks with

a lot of ambition and not much capital proliferate, and

more established firms work to fend off the encroachment.

With the SaaS model coming to be recognized as a useful

way to relieve the pressure, it is virtually certain that take-

up will reach 100 percent.

That may seem hard to believe, especially if you work

in an organization that has come to rely on in-house

technology and in-house operators keeping it running.

But one constant of history is the tendency for a dominant

technology to be replaced swiftly and utterly by a more

efficient and simpler alternative. It is a story you have

seen play out many times. And if you have watched it play

out lately, it was probably not on a DVD.