By Frederik Roeland, Director, Technology Product Management, Finance

Life in the digital age can be more rewarding, but also more demanding. A business must have the agility to respond to today’s market needs, and the foresight to gauge the commercial landscape of tomorrow under multiple sets of conditions to be able to improve competitiveness. These goals can be attained to the fullest by nurturing finance transformation: activities that leverage the unique advantages of your finance team to create value for your institution.

Finance departments play a dual role in any financial services organization. The more tedious one involves accounting for and controlling the results and figures realized by the sales and business-development teams. The second is to determine how processes, investments, funding and operations can be optimized and improve the bottom line.

Finance teams can generate more value by focusing on the strategic second objective. In practice, though, they spend little time on value generation because they tend to get caught up in keeping alive legacy processes, manual interventions and other work to fix financial data, processes and operations. They are encouraged to focus on what the company is doing and the money that comes and goes, instead of what the company should be doing to make money in the first place.

It does not have to be this way. The key is to free finance teams as much as possible from these more mundane matters and to foster higher-order modes of thinking. This will enable them to play a more advanced role in value-generating, strategic finance transformation initiatives. Once this reorientation of priorities has occurred, the focus can shift to choosing which sorts of projects to take up.

You can unleash your human resources

The first step in encouraging a more strategic way of thinking in your finance department is to keep personnel motivated, provide them with tasks that instill a sense of purpose and involve them in projects where they matter most and can add substantial value to the business. This is also paramount in attracting and retaining finance talent.

A business can deploy its finance team in any number of ways in the pursuit of value creation. For some organizations, it might involve spearheading a data governance strategy. For others, it might mean steering the department’s activities toward more advanced analytics and artificial intelligence work streams. As a direct consumer of data flows from different sources, the finance team is well placed to play a key role in either endeavor.

Still other firms might try to create value by involving personnel more in mergers and acquisitions, the startup of a FinTech/neo-bank, or aligning the launch of new digital products.

In any project of choice, the finance team should be able to strengthen the decision making. Scenario analysis, strategic thinking, budgeting and forecasting are the functions that your people should be working on. If they are not, it may send unhealthy signals about your internal processes and operations to auditors and the market.

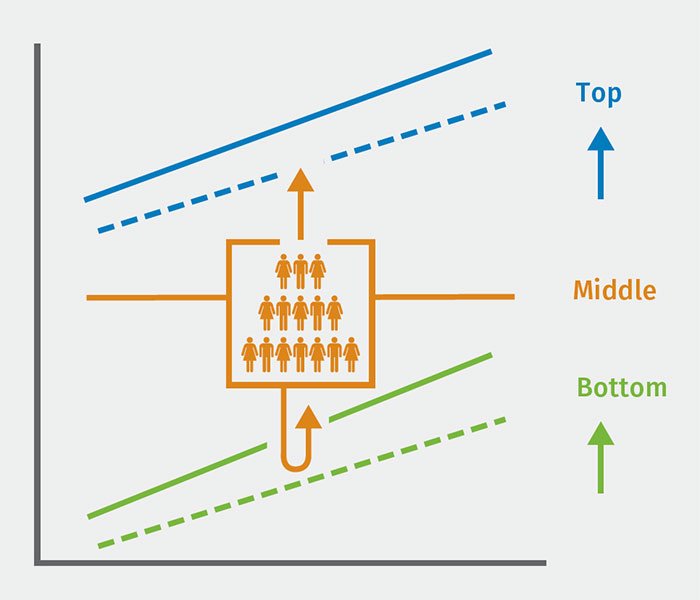

Transitioning from bottom line to top line decisions while engaging the middle line of finance team members.

Getting the most out of your technological resources

Reducing operational constraints is essential to ensuring the finance team can play a key role in strategic initiatives. Yet finance staff members too often are occupied with recurring control and manual tasks, limiting the opportunity to spend time on more purposeful activities. These constraints are often due to inertia – they are done that way because they always have been done that way.

Automation seems like a straightforward solution, but that misses the fact that those rote tasks are the tip of the iceberg. Under the surface you will notice multiple factors that influence the finance workload directly and indirectly:

- An increase in data storage and data initiatives, but data ownership and governance not being properly channeled

- An increase of application programming interface (API) touchpoints in an open architecture, possibly making reconciliation and integration more difficult to manage and survey

- Increased pressures from auditors and regulators to act on the items mentioned above.

Automation is only part of the solution. Without acting on data ownership, aligning with front-end and product introductions, and tackling interface challenges, investments in a finance transformation program may be hard pressed to achieve anticipated benefits.

Picking the right opportunities

Once you are convinced of the value that finance transformation initiatives can add to your business, there no doubt will be many to choose from. You will not be able to do all of them, so you must choose wisely. Finance transformation projects that focus on strategic objectives of senior management are more likely to be accepted, and to succeed, than projects that focus on finance alone. It is essential to the success of a project to expand and align the vision of finance with your organization’s broad strategy in all aspects. Once the critical finance objectives have been aligned and established, it is important to devote sufficient resources to execute the strategy. You will need to free up the best resources for the strategic programs that matter most, while ensuring that business-as-usual activities are not compromised.

The right transformation strategy will strike a balance between maximizing operational efficiency through automation and freeing up your resources on programs where finance can create value and impact the outcome of the strategy (see diagram below). Consider a transition from bottom-line to top-line decisions while engaging the middle office of finance team members as the team moves away from mundane, repetitive tasks and toward strategic projects by automating the recurring work.

Organizations can benefit from a partner that helps roll out programs that provide the right solutions to automate recurring business functions in the finance, risk and regulatory space, and also extends the solution with forward-looking capabilities to strengthen scenario management and strategic decision making.