In this article, we'll explore changes in financial close and consolidation processes, delve into the new data requirements, and examine how CCH Tagetik enhances the scope, speed, and accuracy of the close and consolidation tasks.

The scope of the financial close has expanded — and legacy consolidation systems aren’t keeping up.

Comparing today’s enterprise financial close and consolidation process to processes ten years ago is like comparing Amazon Web Services to a floppy disc. Just as a floppy discs storage capacity is a fraction — of a fraction of a fraction — of Amazon’s cloud capacity, the close processes of the past required a fraction of the data needed today.

With requirements only intensifying, traditional close systems are going the way of the floppy disc: extinct.

The good news is CCH Tagetik has augmented the close's scope, speed, and accuracy with advancements to the tech behind its close and consolidation solution. In this article, we’ll discuss:

- Financial close and consolidation processes: What’s changed?

- New data requirements in the financial close

- How CCH Tagetik augments the scope, speed, and accuracy of close and consolidation

Financial close and consolidation processes: what’s changed?

In the 2024 Magic Quadrant for Financial Close and Consolidation Solutions, Gartner wrote, “Driven by increasingly complex company structures, evolving financial regulations, and multiple systems of record as well as the rise in remote working, organizations now need more efficient, compliant, and collaborative management of their financial close and consolidation processes.”

There was a time when closing and consolidating the books meant just keeping on top of financials, but today’s end-to-end close and consolidation process accounts for processes that extend beyond close management and consolidation. In addition to financial statements, teams must close the books on data related to:

- Lease accounting (IFRS 16 /ASC 842)

- Insurance contracts (IFRS 17 / ASC 944)

- ESG frameworks (CSRD, IFRS S1, and S2, SASB, GRI, and TCFD)

- BEPS Pillar Two

- Tax Provision

- <IR> framework

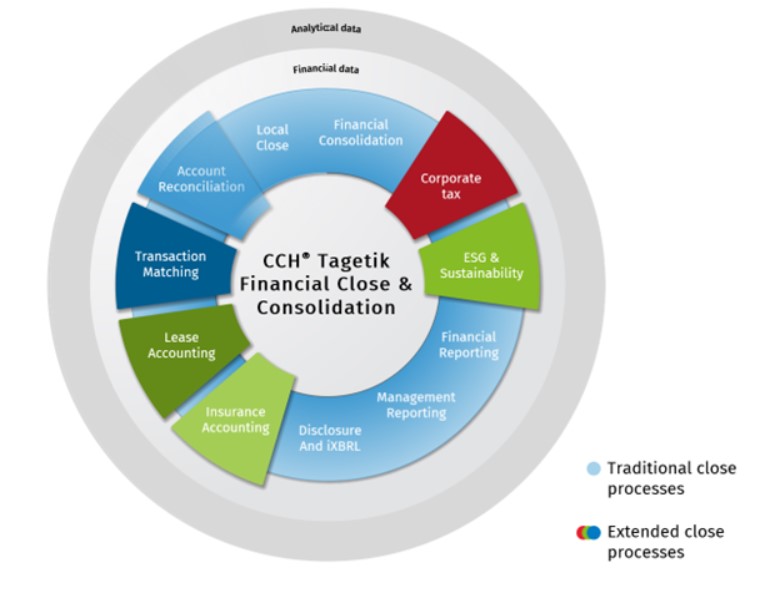

As a result, we can now place financial close’s many moving parts into two categories:

- Standard close and consolidation processes: Close management, financial consolidation, financial and management reporting

- Extended close and consolidation processes: Account reconciliation, transaction matching, ESG, lease accounting, insurance accounting, tax provision and reporting, integrated disclosure

Traditionally, close and consolidation solutions only supported standard processes. But to adequately cover today’s end-to-end close and consolidation needs, solutions must provide functionality for everything that impacts actuals data — including extended processes.

New data requirements in the financial close

Financial close data used to originate solely from ERPs and various CSV files. But now, closing the books requires information from HR systems, data warehouses, tax systems, treasury systems, supply chain systems, commercial systems, and even EHS, carbon, and emissions systems. It’s not just financial data that’s required, but transactional, lease, insurance, HR, commercial, supply chain, tax, and ESG data too.

This influx of diverse unstructured data poses challenges to the close and consolidation systems many teams use. FSN’s CEO, Gary Simon, explains, “Data management is becoming the pre-eminent concern, and legacy consolidation systems designed around the capture of monthly balances are ill-equipped to deal with the complex data demands of the modern era.”

The problem with inadequate financial close systems

Finance has reached an inflection point. Consolidation systems must change to accommodate enormous volumes of granular data across the organization. ERPs, spreadsheets, and point consolidation systems — or a combination of the three — have been the systems of choice for completing some or all financial close and consolidation tasks. But these traditional financial close systems are falling short. Here’s why.

- They’re rigid. Traditional approaches to close and consolidation put users into a box: the systems do what they do, and no more. Any customization required to accommodate new accounting, regulatory requirements – like ESG, tax and integrated disclosure – or business requirements — like M&A, divestitures, new products, or geographical expansion — must be coded or completed in yet another add-on system. They're not flexible, scalable, or agile.

- They’re limited. Meeting today’s monthly close requirements is no longer just a matter of consolidating financial data. It’s managing terabytes upon terabytes of disparate financial, operational, ESG, and tax data while connecting an ever-growing volume of different processes together.

Data requirements have exited the domain of the spreadsheet and entered the realm of generative AI and machine learning — but spreadsheets, ERPs, and point systems can’t expand to employ these technologies at the level finance needs. AI-autofill and suggestions are a nice touch, but they’re not enough for finance teams dealing with enterprise CPM needs. - They’re siloed. Traditional approaches break up close and consolidation processes into remote islands, when these processes should be city centers of collaboration and connectivity. Close processes are completed at many levels of the organization — account, entity, and group levels, for example. When workflows are broken up by the systems and documents that make up each task, there’s no critical path between these close activities.

What’s more, without adequate visibility into downstream processes where data is collected and validated, problems can arise when the data is subsequently merged and consolidated. This lack of traceability of the information often leads to delays in the close process and the need to carry out last minute manual interventions in the data and a lack of full trust in the values being reported.